Demystifying credit risk capital requirements for housing loans

Introduction

APRA’s remit is to protect depositors and promote financial system stability which it does by, amongst other things, requiring banks to hold sufficient capital to withstand shocks and absorb losses. A predominant feature of the capital adequacy framework for banks targets credit risk in housing lending given the high concentration of housing loans in Australian banks’ portfolios. APRA permits two main approaches to calculating capital requirements for credit risk: the standardised approach and the internal ratings-based (IRB) approach, the latter of which is currently approved for use by six of the largest banks in Australia.

In this paper, we explain how the capital adequacy rules for housing lending work and explore two key questions:

- how does APRA ensure that capital requirements for housing lending are sufficient to withstand losses through the cycle; and

- how does APRA ensure that the differences between IRB and standardised capital requirements are appropriate, and limit impacts on competition in the Australian banking system?

Understanding the capital framework for housing lending

Capital requirements for credit risk are a function of credit risk-weights and the minimum capital adequacy ratio.1 These requirements are largely based on the internationally agreed framework developed by the Basel Committee on Banking Supervision with some modifications for Australian circumstances and risks.

The two main approaches for calculating credit risk capital requirements are:

- the standardised approach, which is simple, conservative and caters for a wide range of banks and portfolios; and

- the IRB approach, which seeks to better align capital with risk by permitting banks to use their internal risk models to calculate capital requirements.

Standardised approach

Under the standardised approach, capital requirements for housing lending are based on a common set of risk-weights prescribed by APRA. Standardised risk-weights are generally calibrated at a conservative level because they are less precise, apply to a wide range of banks, and aim to ensure that standardised banks are adequately capitalised on an overall basis. While risk-weights are generally more conservative, there is a lower burden on standardised banks in terms of other supervisory requirements including the management of internal risk models and data reporting.

IRB approach

Under the IRB approach, banks are permitted to use their internal models as inputs to determine the risk-weights for housing lending. Risk-weights under the IRB approach are tailored to the risks of an individual bank and are more precise than standardised risk-weights (that is, sensitive to a wider range of borrower and portfolio risk characteristics). Therefore, the IRB approach leads to more accurate risk measurement, which enables a better alignment of capital to risk.

To use the IRB approach, banks must have robust historical data, a sophisticated risk measurement framework and advanced internal modelling capabilities. Banks must also undergo a rigorous assessment process to be accredited by APRA. IRB banks are subject to more stringent regulatory requirements and more intensive ongoing supervision than standardised banks.

Unlike standardised banks, IRB banks are also required to specifically hold capital for interest rate risk in the banking book (IRRBB), which is expected to be 5 to 7 per cent of total risk-weighted assets (as per proposed changes to the prudential framework).

What are the key drivers of capital requirements for housing lending?

Under the standardised approach, risk-weights for housing lending vary based on the loan-to-valuation ratio (LVR), whether the loan is standard or non-standard,2 whether the loan is for owner-occupation or investment purposes, whether loan repayments are principal-and-interest or interest only, and whether the loan has lenders mortgage insurance (LMI). Depending on these characteristics, a housing loan may be risk-weighted at between 20 per cent and 150 per cent.3

Under the IRB approach, key determinants of housing risk-weights are the banks’ estimates of probability of default (PD, the risk of borrower default), loss given default (LGD, loss as a proportion of the amount owing at default) and exposure at default (EAD, the amount owing at default), and a risk-weight function prescribed by APRA.

The banks’ internal estimates of PD, LGD and EAD are derived by modelling the sensitivity of defaults and losses to a range of borrower and portfolio risk characteristics. Risk drivers in housing loan models typically include:

- borrower characteristics such as the borrower’s debt-to-income ratio, number of borrowers, the borrower’s occupation, and whether the borrower is self-employed;

- loan characteristics such as the LVR, whether the loan is for owner-occupation or investment purposes, whether the loan is revolving or amortising, and whether loan repayments are principal-and-interest or interest only;

- behavioural characteristics such as the extent to which the borrower has made payments ahead of schedule, transaction and payment history relating to the borrower’s other retail products, and the borrower’s arrears history; and

- property collateral characteristics such as whether the property is a detached house or unit, whether the property is located in a metropolitan, regional or remote area, and the number of properties securing the loan.

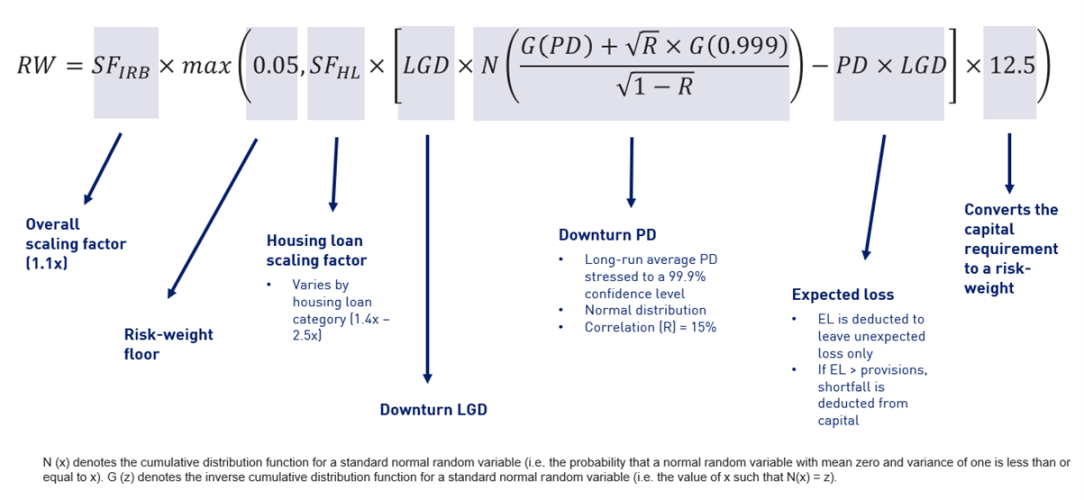

The banks’ PD, LGD and EAD estimates are input into a prescribed risk-weight function (Figure 1). The risk-weight function determines unexpected losses at a 99.9 per cent confidence level, which means that capital is intended to be sufficient to withstand losses in 99.9 per cent of economic scenarios across the cycle. The risk-weight function is dependent on:

- the asset correlation factor, which represents the correlation of credit losses to the economy and is used to transform the banks’ internal estimates of PD to downturn levels. For housing loans, the asset correlation factor is prescribed at 15 per cent; and

- scaling factors, which scale up the model outputs to ensure that capital is adequately calibrated on an overall basis. There is an overall scaling factor (which is set at 1.1) as well as scaling factors depending on the category of housing loan (ranging from 1.4 to 2.5), which represent different levels of risk: owner-occupied principal-and-interest loans; investment loans where the borrower has more than five mortgaged investment properties; and all other loans.

IRB risk-weights are also responsive to changes in economic conditions, largely through the impact of economic factors on the behaviour of borrowers, which has a flow-on effect to the banks’ internal estimates. For example, increases in interest rates might lead to a reduction in payments ahead of schedule, thereby increasing PD estimates and, in turn, IRB risk-weights. Banks can manage the extent of responsiveness of their models to economic factors as part of model design, for example, through the selection, specification and weighting of risk drivers in the model with sensitivity to economic conditions.

APRA expects IRB banks to avoid excessive procyclicality in their internal models, which may lead to risk-weights trending too low in benign periods and too high during periods of economic stress as this might otherwise amplify economic cycles. For example, procyclicality may be dampened by avoiding simple delinquency measures and other behavioural characteristics with short-term prediction horizons. In seeking to dampen procyclicality, IRB banks need to recognise that there is a trade-off with risk-sensitivity and strike an appropriate balance between the two objectives.

Risk-weights are the main driver of overall IRB capital requirements. However, other key components are:

- the minimum capital ratio requirement (MCR). IRB banks must hold an additional capital buffer of 125 basis points as part of their minimum capital requirement; and

- the expected loss (EL) adjustment. IRB banks must compare regulatory expected losses (which are derived from their estimates of PD, LGD and EAD) against provisions held for credit losses and deduct any shortfall in provisions from the capital base. This leads to an increase in the capital requirement.

How does APRA ensure that capital requirements for housing lending are sufficient to withstand losses through the cycle?

While capital requirements for housing lending are underpinned by the Basel capital framework, over time, APRA has strengthened the Australian framework beyond minimum Basel requirements given the high concentration of housing loans in Australian banks’ lending portfolios. Key milestones that have materially impacted capital requirements for housing lending are:

- an increase in the input floor on LGD estimates for housing lending from 10 per cent to 20 per cent in 2008 due to concerns about the robustness of the banks’ internal LGD models;

- a rise in IRB risk-weights for housing loans in 2016 (through an increase in the asset correlation factor) in response to a recommendation from the 2014 Financial System Inquiry to narrow the gap between IRB and standardised risk-weights;

- the implementation of ‘unquestionably strong’ capital ratio requirements in 2020; and

- revisions to the broader capital framework effective from 1 January 2023. As part of these revisions, APRA has strengthened the framework for housing lending by:

- introducing a minimum IRB risk-weight floor of 5 per cent as well as input floors on PD and EAD estimates;

- increasing capital requirements for investment loans and interest only loans through higher scaling factors (IRB approach) and higher risk-weights (standardised approach);

- introducing higher capital buffer requirements to formalise the ‘unquestionably strong’ capital framework. This includes a higher countercyclical buffer (with a baseline level above zero) and a higher capital conservation buffer for IRB banks;

- reducing the LGD floor from 20 per cent to 10 per cent and allowing IRB banks to use internal estimates of LGD where such estimates are assessed by APRA to be robust and appropriately calibrated, thereby improving the sensitivity of capital requirements to underlying risk;

- implementing additional constraints on internal modelling. For example, internal modelling is now not permitted for non-standard loans and LMI recoveries; and

- enhancing disclosure standards for IRB banks to promote market discipline.

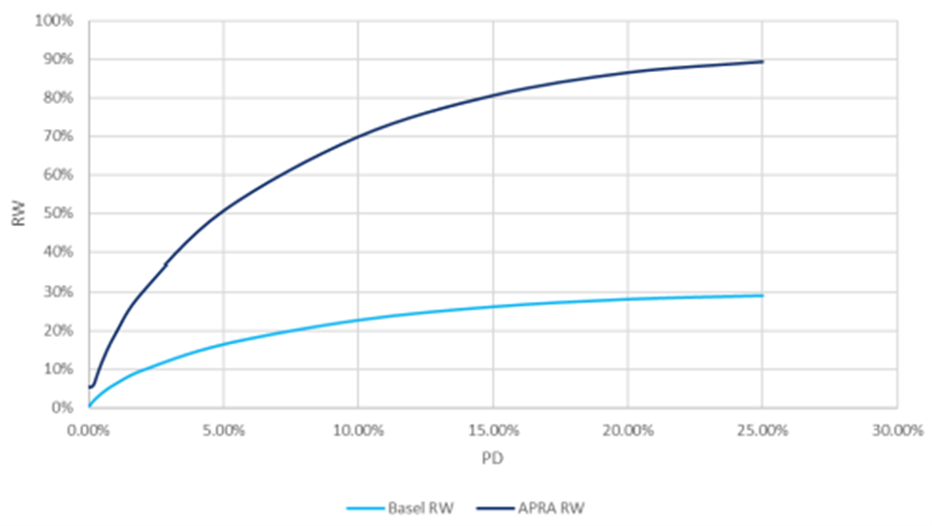

The main elements of super-equivalence in APRA’s capital requirements for housing loans compared to the Basel framework are summarised in Table 1. The degree of super-equivalence in APRA’s requirements varies based on the risk characteristics of the loan. For example, under the IRB approach, for an owner-occupied principal-and-interest loan with an LGD estimate of 5 per cent, APRA’s capital requirement is 3 to 8 times higher than the minimum Basel requirement depending on the PD estimate (Figure 2).

Parameter | APRA | Basel |

IRB approach | ||

| Overall scaling factor | 1.1 | 1 |

| Housing loan scaling factors | 1.4 – 2.5 | 1 |

| Risk-weight floor | 5 | No risk-weight floor |

| LGD floor | 10 | 5 |

| Non-standard loans | Excluded from the IRB approach | Modelling is permitted |

| LMI recoveries | Prescribed factor (20 per cent) | Modelling is permitted |

Standardised approach | ||

| Investment loans | Higher risk-weights are applied to all investment loans | Higher risk-weights are applied to investment loans that are materially dependent on property investment income for loan servicing |

| Interest only loans | Higher risk-weights are applied to interest only loans | No additional increase in risk-weights for interest only loans |

| Non-standard loans | Broader definition of non-standard loans | Narrower definition of non-standard loans |

Table 1: Comparison between APRA requirements and minimum Basel requirements

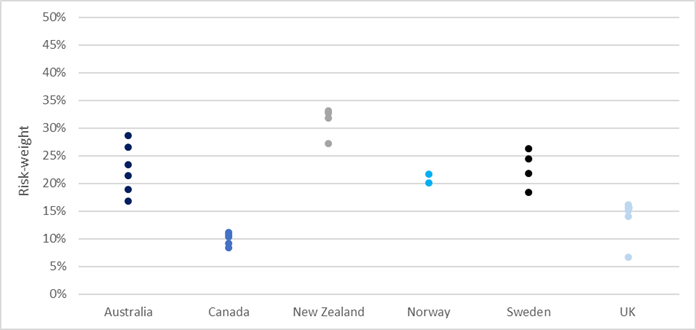

Other jurisdictions have also made adjustments to minimum Basel requirements to increase risk-weights for housing lending, largely focused on the IRB approach. These adjustments have been made in response to concerns about the availability of downturn data and robustness of modelling practices but, more generally, as part of macroprudential responses to domestic housing market conditions. For example, Hong Kong and Sweden have introduced a 25 per cent risk-weight floor at a portfolio level; Norway has implemented a 20 per cent risk-weight floor; New Zealand has increased the correlation factor for investment loans and high LVR loans, and implemented higher minimum values for LGD; and Canada has introduced a higher correlation factor for riskier loans and higher floors on LGD estimates.

Figure 3 compares IRB risk-weights across various jurisdictions. There is a wide dispersion in risk-weights across large banks internationally, which reflect differences in housing markets in which banks operate as well as the extent to which supervisors in other jurisdictions have implemented additional measures above minimum Basel requirements.

In addition to a robust regulatory framework, APRA ensures that capital requirements for housing lending are sufficient to withstand losses across the cycle through rigorous supervision of the banks’ internal models. This supervision comprises three main components:

- Regulatory assessment and approval of IRB model changes. This is a key control to ensure that only changes with sound motivation and supporting evidence are implemented by banks. We also note that changes submitted to APRA for assessment have also undergone a governance process within the bank that involves an independent validation assessment;

- On-site prudential reviews. APRA uses on-site reviews to assess the health of existing IRB models as well as relevant governance and model risk practices. Banks are expected to proactively identify issues and have credible plans in place to address them in a timely manner. This may involve temporary increases in the capital held; and

- Off-site data analysis. IRB banks must submit data to APRA on a quarterly basis and this allows analysis of trends and outliers, which in turn may form the basis of queries and investigations. Additional data collections may also be initiated as needed to facilitate peer benchmarking.

How do IRB and standardised capital requirements compare?

In principle, capital requirements for housing lending under the IRB approach can be higher or lower than the standardised approach depending on the underlying risk characteristics of a loan. On average, the capital framework has been calibrated such that IRB capital requirements tend to be lower than standardised capital requirements. This calibration has two policy objectives:

- to encourage investment by banks in advanced modelling capabilities and associated technology, data and specialist skills. Such investment is significant and ongoing but provides substantial risk management benefits such as:

- improving a bank’s ability to identify the risk profile of its lending and other business activities;

- facilitating risk-based and evidence-based decision-making and portfolio management;

- ensuring risk is properly priced;

- supporting financial innovation and the bank’s ability to respond to market changes and changes in risk profile; and

- to enable banks to more accurately allocate capital for risk.

How does APRA ensure that differences between IRB and standardised capital requirements are appropriate?

APRA has made the IRB approach accessible to any bank that can model its risks to an acceptable standard. This includes the introduction of a staged accreditation process whereby a bank may use internal models for regulatory capital purposes for some credit portfolios ahead of others. However, APRA also recognises that IRB accreditation may not be cost-effective for some smaller banks given their lack of scale and diversification. Therefore, while differences between the IRB and standardised approaches are embedded in the capital framework by design, there are also in-built safeguards to ensure that any capital benefit to IRB banks is not excessive and does not unfairly disadvantage standardised banks. The main safeguards include:

- a capital floor that limits the capital benefit to IRB banks to 72.5 per cent of risk-weighted assets under the standardised approach;

- input and output floors for risk estimates and risk-weights under the IRB approach;

- a rigorous APRA approval and validation process for IRB banks; and

- comprehensive disclosure standards for IRB banks. Among other things, IRB banks are required to calculate and report risk-weighted assets under both the IRB and standardised approaches.

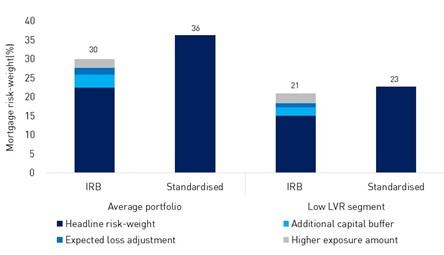

Based on recent data, the average headline (or reported) risk-weight for housing lending is 22 per cent under the IRB approach and 36 per cent under the standardised approach, representing a difference of 14 percentage points. However, headline risk-weights do not provide the complete picture of overall capital requirements. There are other differences between the two approaches that mean the real difference between IRB and standardised capital requirements is much narrower than implied by a simple comparison of headline risk-weights.

In addition to risk-weights, other key differences between the IRB and standardised approaches include:

- Capital ratio requirement. IRB banks have higher minimum capital adequacy ratios than standardised banks (all else equal) due to an additional capital conservation buffer requirement of 125 basis points;

- Expected loss adjustment. IRB banks must compare regulatory expected losses against provisions and deduct any shortfall in provisions from the capital base, which increases overall capital requirements. This adjustment is not applicable to standardised banks;

- EAD factor. IRB banks must apply a higher factor (100 per cent) to the exposure (or EAD) amount for any undrawn component of a loan (for example, due to amounts paid in excess of scheduled loan repayments that can be redrawn at any time). The relevant EAD factor under the standardised approach is 40 per cent;

- IRRBB. IRB banks are required to hold capital for IRRBB. There is no equivalent requirement for standardised banks (although it is arguable whether some part of the higher standardised credit risk-weights might account for interest rate risk);

- Operational costs. IRB banks have higher operational costs from investing in and maintaining data and risk management systems to support the use of the IRB approach. There are strict expectations relating to the monitoring and validation of models, with regular adjustments to those models often necessary; and

- Responsiveness of capital requirements through the cycle. There are differences in how standardised and IRB capital requirements change over time, including during periods of stress. Standardised capital requirements are generally stable over the economic cycle. In contrast, IRB capital requirements are more responsive to changes in the cycle and will tend to increase while economic conditions are deteriorating and decrease during benign periods. This means that the difference in standardised and IRB capital requirements will also vary over the cycle and is likely to be smallest during periods of stress. The current point in the cycle appears reasonably favourable, which means that the divergence in capital requirements is higher than average.

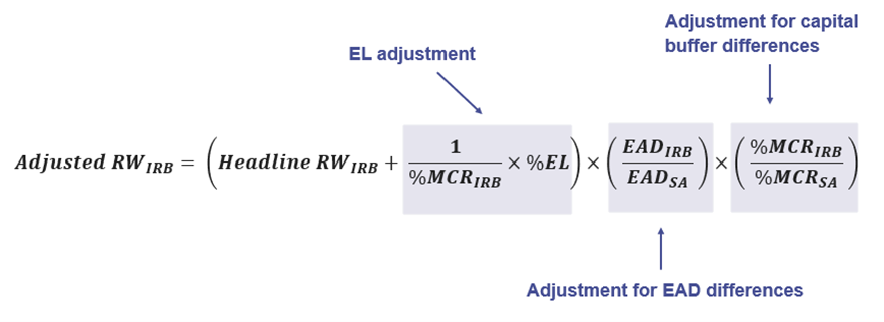

To enable a more like-for-like comparison of IRB and standardised risk-weights, adjustments need to be made to IRB headline risk-weights taking into account other key differences in capital requirements (Figure 4). Based on this comparison, the difference in IRB and standardised risk-weights is only 6 percentage points (Figure 5). For loans with an LVR of less than 60 per cent, the gap is even smaller at 2 percentage points.

APRA estimates that the average pricing differential for housing lending due to differences in IRB and standardised capital requirements is 5 basis points.4 Taking into account the IRRBB capital charge and higher operational costs for IRB banks would further reduce this pricing differential. The pricing differential is relatively small and demonstrates that the capital framework has effective mechanisms in place to prevent excessive divergence between the IRB and standardised approaches.

Conclusion

APRA ensures that capital requirements for housing lending under both the IRB and standardised approaches are sufficient to withstand losses across the cycle through the implementation of a robust regulatory framework and rigorous ongoing supervision. There are differences between IRB and standardised requirements, reflecting the expectation of more sophisticated risk management by larger, complex institutions. The differences also seek to provide an incentive for banks to invest in advanced modelling capabilities, improve risk management frameworks and better align capital with risk. APRA has robust mechanisms in place to prevent excessive divergence between IRB and standardised capital requirements and limit any detrimental effect on competition. We conclude that the current capital framework delivers on the goals of robust and equitable capital adequacy rules for Australian banks.

Anthony Coleman Head of Credit Risk Analytics | Niruba Thavabalan Risk Specialist |

Footnotes

1Risk-weights are percentage factors that adjust for the credit risk of different types of assets. Risk-weighted assets are calculated by multiplying the risk-weight for a particular asset or loan by the exposure amount and summing across all assets and loans.

2 A standard loan is a loan that meets prudent criteria for legal enforceability of the mortgaged property securing the loan, property valuation, loan serviceability and loan documentation among other things.

3 A further reduction may be applied to the capital requirement where the loan has an undrawn component, for example, due to amounts paid in excess of scheduled loan repayments that can be redrawn at any time.

4The pricing differential is estimated using the following conceptual framework:

We note that the capital requirement is only one of several inputs into banks’ pricing strategies.

Disclaimer

APRA disclaimer and copyright

This paper represents the views of the authors only, and any errors are our own.

While APRA endeavours to ensure the quality of this publication, it does not accept any responsibility for the accuracy, completeness or currency of the material included in this publication and will not be liable for any loss or damage arising out of any use of, or reliance on, this publication.

© Australian Prudential Regulation Authority (APRA)

This work is licensed under the Creative Commons Attribution 3.0 Australia Licence (CCBY 3.0). This licence allows you to copy, distribute and adapt this work, provided you attribute the work and do not suggest that APRA endorses you or your work. To view a full copy of the terms of this licence, visit https://creativecommons.org/licenses/by/3.0/au/

ASIC disclaimer and copyright

This information paper does not constitute legal advice. We encourage you to seek your own professional advice to find out how the Corporations Act and other applicable laws apply to you, as it is your responsibility to determine your obligations.

Examples in this information paper are purely for illustration; they are not exhaustive and are not intended to impose or imply particular rules or requirements.

© Australian Securities and Investments Commission