COVID-19 Early Release Scheme - Issue 11

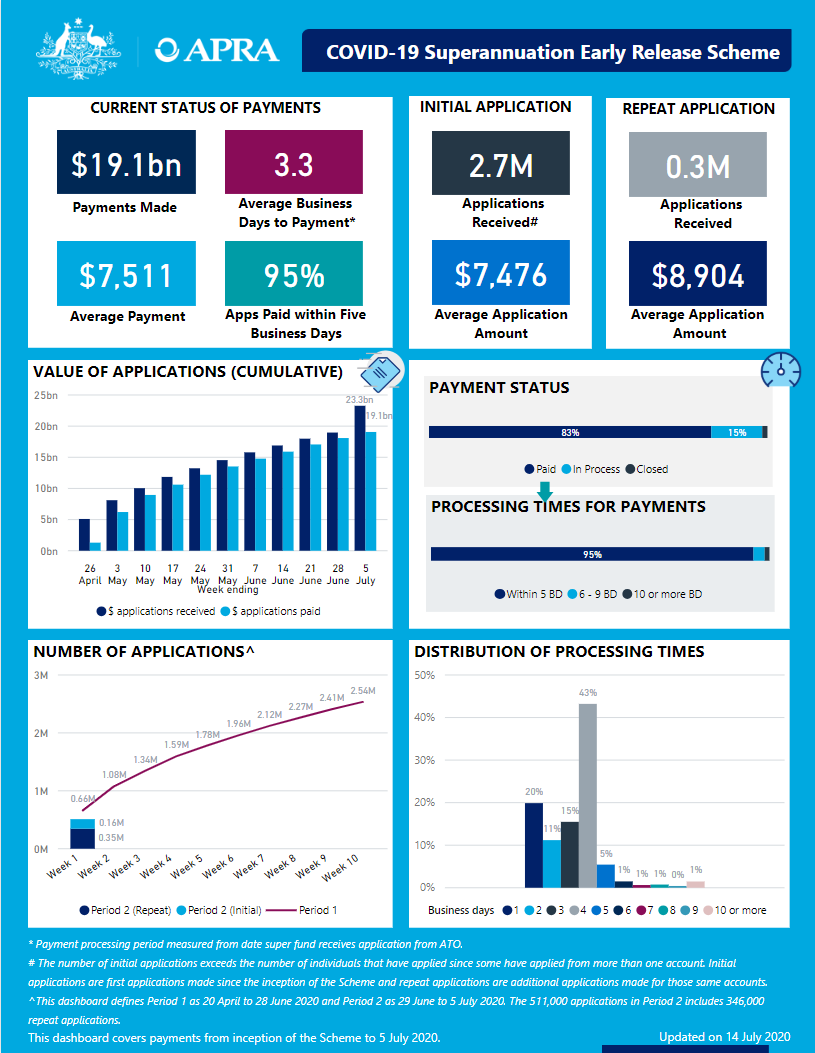

This dashboard contains the latest data on the COVID-19 Superannuation Early Release Scheme, from inception of the Scheme to 5 July 2020.

High volumes of applications are expected for the start of the second trancheof the COVID-19 Early Release Scheme in early July. This may impact the processing time for payments being made by funds.

An accessible version of the dashboard is available here.

Additional Commentary

APRA has received early release data submissions for the period ended 5 July 2020 from 176 funds. Funds have submitted on a best endeavours basis.

Over the period from the inception of the scheme on 20 April to 5 July, payments made to eligible members have taken an average of 3.3 business days after receipt by funds of the application from the Australian Tax Office (ATO) and 95.2 per cent have been made within five business days.

This reporting week covers the week from 29 June to 5 July. It includes the end of the period for which members could apply for up to $10,000 for the 2019/20 financial year and the start of the period for which members could apply for up to $10,000 for the 2020/21 financial year.

The 511,000 applications received by funds during the week from 29 June to 5 July includes a mix of applications received in both the 2019/20 and 2020/21 financial years. It is a significant increase in applications compared to the week of 22 June to 28 June, where 127,000 applications were received by funds, reflecting the start of repeat applications in the 2020/21 financial year.

An ‘initial application’ is the first application made in respect of a member account whether this occurred in the 2019/20 financial year application period or the 2020/21 financial year application period.

A ‘repeat application’ is an application for a member account that previously submitted an initial application. All such applications are for the 2020/21 financial year application period.

The 511,000 applications received during this reporting week (29 June to 5 July) is lower than the 665,000 applications received during the first week of the early release scheme (20 April to 27 April).

Out of the 511,000 applications received, 165,000 were for members applying for early release for the first time (initial application) and 346,000 were for members applying for the second time (repeat application). The average amount applied for by those making a repeat application was $8,904.

The 165,000 initial applications brings the total number of initial applications to 2.7 million since the inception of the scheme. It is important to note that the number of initial applications reflects the number of member accounts that have been accessed across entities with more than four members and exceeds the number of individuals that have made an application due to some individuals seeking withdrawals from more than one superannuation fund.

Over the week to 5 July, superannuation funds made payments to 132,000 members, bringing the total number of payments paid by funds to their members to approximately 2.54 million since inception with some of the payments being repeat payments as a result of the commencement of the second period in which members can make an application. The total value of payments during the week was close to $1 billion, with $19.1 billion paid since inception. The average payment made over the period since inception is $7,511.

At 5 July 2020, 83 per cent of applications received since inception had been paid, down from 95 per cent at 28 June 2020 given the large number of new applications received during the week.

Fund-level data

The fund-level data shows that 151 of the 176 funds (86 per cent) that submitted data made early release payments in the period since inception to 5 July 2020. (Note that the fund-level data includes 40 funds for which the data has been published as a group in order to protect the privacy of information for individual members). Further, 116 of the funds have reported second applications received.

Among all funds that made payments, 114 (75 per cent) completed more than 90 per cent of payments within the five business days guideline indicated by APRA. Further, with limited exceptions (1.5 per cent), payments to members have been completed within nine or less business days from receipt of applications from the ATO.

The 10 funds with the highest number of applications received from the ATO have made 1.68 million payments worth a total of $12.50 billion. The average payment from these funds was $7,427, with 96 per cent of payments made within five days.

Details of the industry-level data is provided below:

• This link provides details on payments and processing timeframes for funds that have made payments to members in the period ending 5 July 2020.

• This link provides a summary of the data that has been reported to APRA by funds for that period.

High volumes of applications are expected for the start of the second tranche of the COVID-19 Early Release Scheme in early July. This may impact the processing time for payments being made by funds.

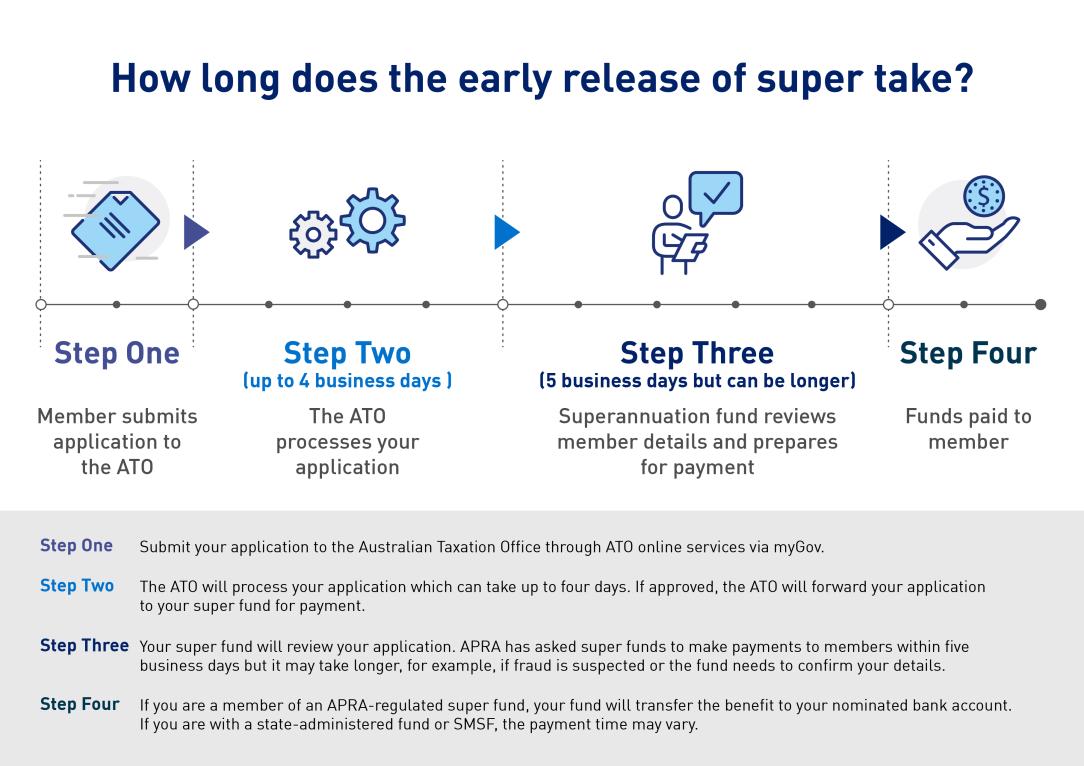

A text version of the infographic is available here.

Guideline payment processing time for an application made on Wednesday 1 July would be Tuesday 14 July (4 business days processing by the ATO and 5 business days processing by the fund). High volumes may result in delays to this processing time.

Do you have questions about your personal application?

APRA has set out a five day guidance period for payments after receipt of applications from the ATO by funds, but also acknowledges that these timeframes may extend slightly where a Registered Superannuation Entity (RSE) licensee experiences a high volume of applications at any particular time. Delays can also occur in exceptional circumstances – such as where the RSE licensee’s automated checking has identified that additional fraud or other verification steps are required, or where the payment is being made from interests held in defined benefit funds.

If you do not believe you have received the funds you have applied for within a reasonable timeframe it is recommended that you contact your trustee directly to determine if there is a specific reason for the delay.