COVID-19 Early Release Scheme - Issue 23

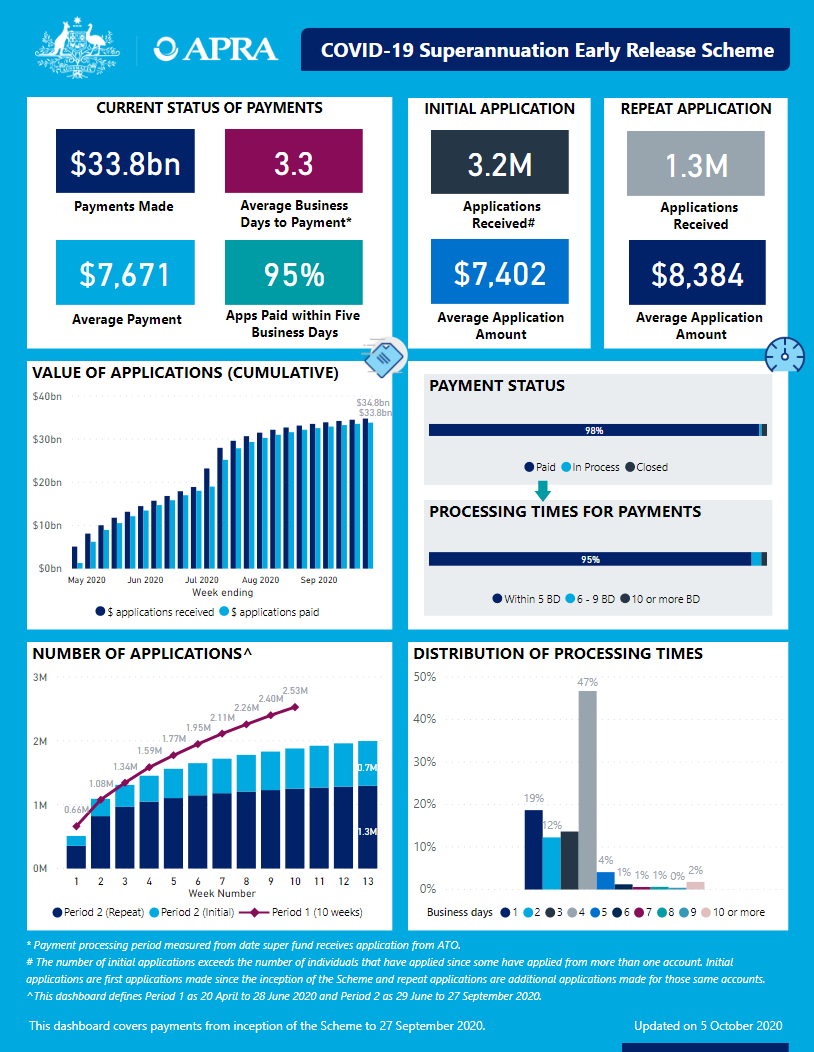

This dashboard contains the latest data on the COVID-19 Superannuation Early Release Scheme, from inception of the Scheme to 27 September 2020:

An accessible version of the dashboard is available here.

Additional Commentary

APRA has received early release data submissions for the period ended 27 September 2020 from 175 funds. Funds have submitted on a ‘best endeavours’ basis.

Over the period from the inception of the scheme on 20 April to 27 September, payments made to eligible members have taken an average of 3.3 business days after receipt by funds of the application from the Australian Tax Office (ATO) and 95 per cent have been made within five business days.

Over the week to 27 September, 36,000 applications were received by funds of which 22,000 were initial applications and 14,000 were repeat applications. Initial applications total 3.2 million and repeat applications total 1.3 million since the inception of the scheme.

Over the week to 27 September, superannuation funds made payments to 36,000 members, bringing the total number to 4.4 million since inception. The total value of payments during the week was $267 million, with $33.8 billion paid since inception. The average payment made over the period since inception is $7,671 overall and $8,384 when considering repeat applications only.

As at 27 September 2020, 98 per cent of applications received since inception had been paid.

Fund-level data

The fund-level data shows that 152 of the 175 funds that submitted data made early release payments in the period since inception to 27 September 2020 and 140 of these also reported repeat applications received. (Note that the fund-level data includes 40 funds for which the data has been published as a group in order to protect the privacy of information for individual members).

Among all funds that made payments, 101 (66 per cent) completed more than 90 per cent of payments within the five business days guideline indicated by APRA. With limited exceptions (1.8 per cent), payments to members have been completed within nine or fewer business days from receipt of applications by funds from the ATO.

The 10 funds with the highest number of applications received from the ATO have made 2.9 million payments worth a total of $22.3 billion. The average payment from these funds was $7,605 with 96 per cent of payments made within five days.

Details of the industry-level data (entities with more than four members) is provided below:

- This link provides details on payments and processing timeframes for funds that have made payments to members in the period ending 27 September 2020.

- This link provides a summary of the data that has been reported to APRA by funds for that period.

- The reporting week from 29 June 2020 to 5 July 2020 included the end of the period for which members could apply for up to $10,000 for the 2019/20 financial year and the start of the period for which members could apply for up to $10,000 for the 2020/21 financial year. It therefore included a mix of applications received that relate to each of the 2019/20 and 2020/21 financial years.

- An ‘initial application’ is the first application made in respect of a member account whether this occurred in the 2019/20 financial year application period or the 2020/21 financial year application period. A ‘repeat application’ is an application for a member account that previously submitted an initial application. All repeat applications relate to the 2020/21 financial year application period.

- The number of initial applications is measured by member accounts and exceeds the number of underlying individuals with approved applications since some individuals have applied across more than one superannuation account.

Do you have questions about your personal application?

APRA has set out a five day guidance period for payments after receipt of applications from the ATO by funds, but also acknowledges that these timeframes may extend slightly where a Registered Superannuation Entity (RSE) licensee experiences a high volume of applications at any particular time. Delays can also occur in exceptional circumstances – such as where the RSE licensee’s automated checking has identified that additional fraud or other verification steps are required, or where the payment is being made from interests held in defined benefit funds.

If you do not believe you have received the funds you have applied for within a reasonable timeframe it is recommended that you contact your trustee directly to determine if there is a specific reason for the delay.