Consultation on draft guidance for financial contingency and resolution planning

APRA has today released draft guidance on financial contingency and resolution planning. The guidance sets out principles and examples of better practice to assist entities in meeting their requirements under the proposed new prudential standards, CPS 190 Financial Contingency Planning (CPS 190) and CPS 900 Resolution Planning (CPS 900).

As a resolution authority, one of APRA’s core functions is to plan for the potential failure of a regulated entity, to ensure that losses to beneficiaries and disruption to the broader financial system can be minimised. The new standards and guidance aim to ensure that regulated entities are better prepared for situations that may threaten their viability and that, in the unlikely case of failure, barriers to achieving an orderly resolution are removed. These reforms are being introduced in a proportionate manner, with smaller and less complex entities subject to fewer requirements.

Consultation on guidance

APRA’s draft prudential practice guides, CPG 190 Financial Contingency Planning (CPG 190) and CPG 900 Resolution Planning (CPG 900), are open for consultation from 6 September 2022 until 6 December 2022. In drafting the guidance, APRA has paid particular attention to areas where entities have requested greater clarity on the proposed new prudential standards, CPS 190 and CPS 900.

The objectives of the guidance are set out below:

- CPG 190 is intended to assist entities in meeting the key requirements of the proposed new prudential standard. It provides further explanation of the outcomes that APRA expects, so that entities can meet these expectations through their actions. It is principles-based, rather than prescriptive, and includes examples of better practice.

- CPG 900 sets out a framework for how APRA expects to engage with entities in developing and implementing a resolution plan. The proposed draft guidance explains what is expected of entities in the resolution planning process and sets out the factors that APRA will have regard to in developing resolution plans for individual entities.

As part of this consultation, APRA has also mapped requirements in the proposed prudential standards to relevant guidance in the draft CPG 190 and CPG 900. The integrated versions of draft CPG 190 and CPG 900 have been provided as an additional resource, to assist industry in understanding APRA’s proposed reforms in totality. APRA is interested in stakeholder feedback on whether this integrated approach is helpful for engaging on the proposed reforms.

APRA welcomes feedback on the draft prudential practice guides, CPG 190 and CPG 900. Submissions should be emailed to policydevelopment@apra.gov.au and addressed to: General Manager, Policy.

Finalising the standards

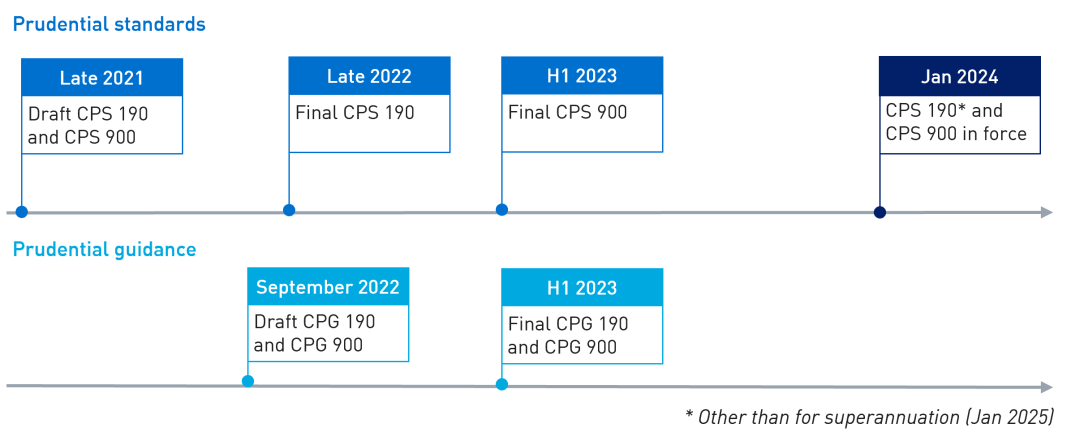

The proposed CPG 190 and CPG 900 have been prepared on the basis of the draft prudential standards released for consultation late last year. APRA is currently reviewing issues raised by stakeholders through this consultation, and is preparing a response to submissions. In the event that revisions are made to CPS 190 and CPS 900, APRA will ensure that these are reflected in APRA’s final guidance.

Based on APRA’s preliminary review of stakeholder submissions, APRA does not expect to make material revisions to the draft proposals for CPS 190. Respondents were largely supportive of the direction of CPS 190, and primarily sought guidance on certain requirements; this has been reflected in the draft CPG 190. APRA plans to finalise CPS 190 later this year.

Stakeholder feedback on CPS 900 was more substantive, with entities generally less familiar with the way that resolution planning would occur in practice. APRA intends for CPS 900 to be implemented on an entity-by-entity basis, to ensure that resolution plans are appropriate for the particular circumstances of an individual entity. While this would ensure a more proportionate approach, and reduce overall burden, it means that the exact outcomes of the standard for individual entities will not be known in advance.

To assist entities in understanding CPS 900, the draft CPG 900 sets out the outcomes APRA is seeking to achieve through resolution planning. It explains APRA’s approach to decision-making and demonstrates how entity feedback would be considered in implementing various CPS 900 requirements. APRA plans to work closely with individual entities in implementing the standard.

APRA plans to finalise CPS 900 in the first half of 2023, after reviewing feedback on the proposed draft guidance. Entities may wish to provide additional feedback on the proposed CPS 900 through this consultation. APRA expects that some small revisions to CPS 900 may be appropriate, based on current industry feedback, including to clarify the Board’s role in resolution planning and APRA’s expectations relating to disclosure on resolution planning.

Next steps

To summarise, next steps will be centred on:

- Consulting on guidance: the consultation on the draft prudential practice guides will close in December 2022. APRA plans to finalise the guidance, CPG 190 and CPG 900, in the first half of 2023.

- Finalising the standards: APRA is planning to finalise CPS 190 later this year and CPS 900 in the first half of 2023.

Following finalisation of the standards, APRA will be engaging with entities on their approach to implementation. While APRA is planning for CPS 900 to be effective from 1 January 2024, these requirements will not need to be met until APRA advises a particular entity that it is commencing resolution planning. APRA plans to engage with entities well before the commencement of formal resolution planning.

Timeline of next steps

Yours sincerely,

John Lonsdale

Deputy Chair