Consultation - draft guidance on remuneration

To: All APRA-regulated entities

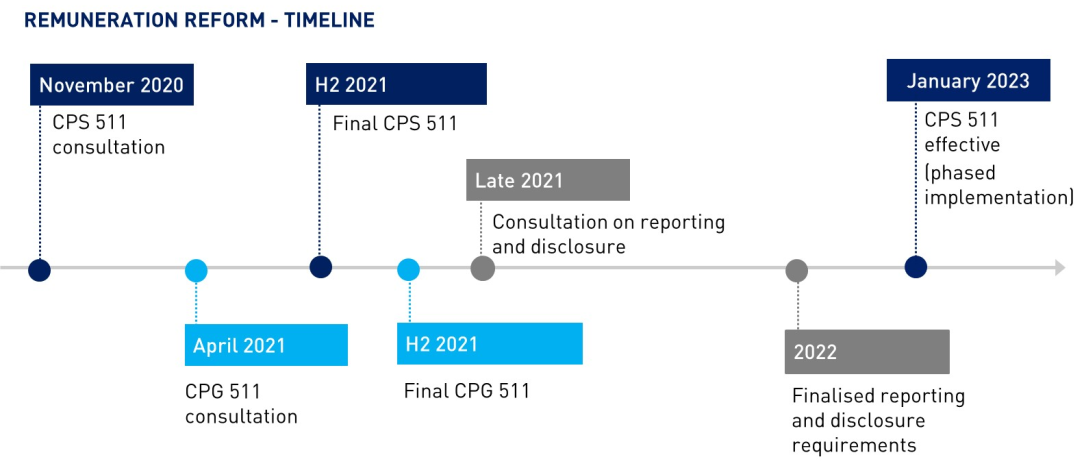

APRA has today released draft guidance on remuneration practices, for consultation. The guidance, Prudential Practice Guide CPG 511 Remuneration (CPG 511), sets out principles and examples of better practice to assist entities in meeting the requirements proposed in the new prudential standard, CPS 511 Remuneration (CPS 511).

The aim of the new standard and guidance is to improve remuneration practices across all regulated industries, to deliver:

- stronger incentives for individuals to manage proactively risks they are responsible for;

- appropriate consequences for poor risk outcomes; and

- increased transparency and accountability on remuneration.

A prudent remuneration policy is an important component of sound governance. An entity’s long-term soundness requires prudent incentive structures and clear accountabilities for outcomes. In particular, senior executives should not be financially rewarded where there are failings in risk management.

Consultation on guidance

APRA’s draft guidance (CPG 511) is open for consultation from 30 April 2021 until 23 July 2021. The guidance supports the new standard, providing principles and good practice on key issues such as defining non-financial measures of performance and applying a material weight to these measures in determining variable remuneration. Ultimately, it is for the Board to determine how to apply these principles in a way that is appropriate to their entity’s business model and particular risks.

In drafting the guidance, APRA has paid particular attention to areas where greater clarity has been requested by entities. APRA has also sought to address the findings from the Royal Commission and the principles for sound compensation practices of the Financial Stability Board.

APRA welcomes feedback on the draft guidance (CPG 511). Submissions should be emailed to policydevelopment@apra.gov.au and addressed to: Mr Gideon Holland (General Manager Policy, APRA).

Finalising the standard

The second consultation on the proposed standard CPS 511 closed in February 2021 and APRA is currently reviewing issues raised by stakeholders. APRA is preparing a response to submissions paper, and plans to finalise this prudential standard later this year.

Based on our preliminary review of industry submissions, which were largely supportive of the direction and did not raise new issues, APRA does not expect to make material revisions to the current proposals. In the event that revisions are made, APRA will ensure that the final standard CPS 511 and guidance CPG 511 are appropriately aligned. APRA will also make potential adjustments following the finalisation of the Financial Accountability Regime.

Reporting and disclosure

APRA is currently conducting a data study with selected entities, to inform its approach to reporting and disclosure requirements. These requirements will be developed and consulted on with industry in late 2021.

In the lead up to the new standard coming into effect in 2023, APRA expects that entities will seek to improve and maintain transparency on their remuneration arrangements. In particular, entities should consider how they will publicly demonstrate that they meet CPS 511 requirements, with clear, comprehensive and timely disclosures.1 This could include regular disclosure on:

- remuneration governance and oversight, including qualitative information about the remuneration policy, adjustment tools and process to determine remuneration outcomes;

- remuneration design, including financial performance and non-financial measures, the rationale for why these measures have been chosen and the weighting applied to them;

- remuneration outcomes for specified roles, including highly-paid material risk-takers, aggregated as appropriate but sufficient in detail to demonstrate how remuneration outcomes have related to performance and risk outcomes; and

- any consequence management applied, including the value of and rationale for downward adjustments to remuneration.

In providing transparency, a careful balance is required to protect commercial-in-confidence information and the privacy of individuals. Entities should consider how to maintain these protections while also providing sufficient information to demonstrate how remuneration arrangements are designed and have operated in practice.

Next Steps

To summarise, next steps will be centred on:

- Consulting on guidance (CPG 511): the consultation on the draft guidance (CPG 511) will close in July 2021, and APRA plans to finalise it in the second half of 2021.

- Finalising the prudential standard (CPS 511): APRA is planning to finalise the new standard in the second half of 2021. Entities will be expected to comply with the new CPS 511 requirements beginning from 1 January 2023, under a staged implementation approach.2

- Reporting and disclosure: APRA’s data study with a sample of entities will be a key input in developing reporting and disclosure requirements for remuneration, which will be consulted on in late 2021.

Yours sincerely,

John Lonsdale

Deputy Chair

Footnotes:

1 Public disclosure of certain executive and director remuneration is required by listed companies in annual director reports, set by section 300A of the Corporations Act 2001 (Corporations Act). Superannuation entities are also subject to remuneration disclosure requirements under section 29QB of the Superannuation Industry (Supervision) Act 1993 (SIS Act).

2 Under this approach, ADIs that are significant financial institutions (SFIs) would be expected to implement by 1 January 2023; insurers and RSE licensees that are SFIs by 1 July 2023; and all other entities (non-SFIs) by 1 January 2024.