Class action and the growing importance of Directors and Officers Insurance

Insight Issue 4 2018

In addition to their traditional day-to-day obligations and duties, company directors face increasingly complex responsibilities, including ultimate responsibility for their company’s governance around risks such as climate change, cyber risk and data privacy. Another risk they need to manage is the growing frequency of law suits against companies. The term “class action” is now part of the general insurance lexicon, and the industry is being forced to come to terms with their increased presence.

Class actions are costly in both dollar terms and other costs, such as loss of trust. To date, the top three securities class action settlements have been Centro ($200 million), Aristocrat ($144.5m) and QBE ($132.5m). These figures may soon be surpassed; the financial services Royal Commission is yet to finish and multiple class actions have already been launched this year, seeking damages totalling hundreds of millions of dollars.

In this environment, it is vital that company directors can make informed decisions on behalf of their companies without the fear of being held personally liable. An inability to do so would have far reaching consequences as a lack of effective decision-making could hamper business development, slow the economy and impact negatively on the broader community. Directors and Officers (D&O) Insurance plays a critical protection role by transferring a director’s personal liability risk to the insurer, subject to the policy’s terms and conditions.

D&O has faced challenges over an extended period resulting in a more cautious approach to underwriting and the withdrawal of some cover. This article examines developments in the D&O insurance market, particularly what is termed “Side C cover” [1], which is triggered when a securities class action is made against an entity. It also outlines APRA’s role in assisting insurers to keep this product on a strong and sustainable footing into the future.

Rising premiums and claims development

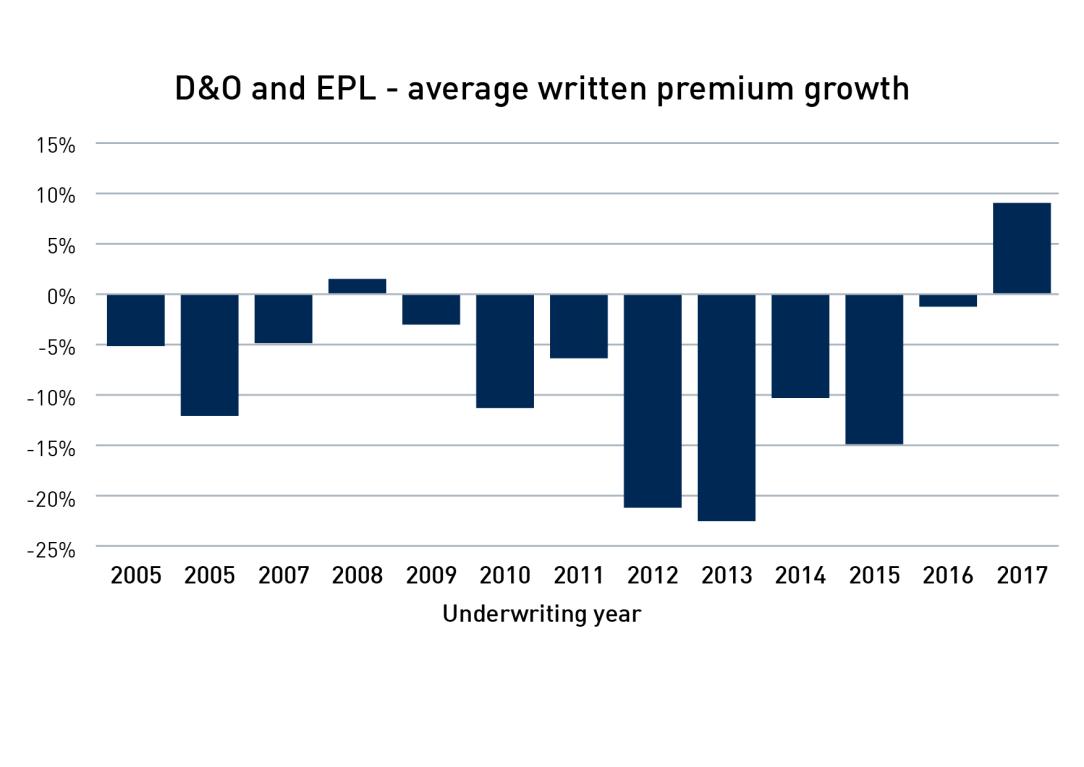

D&O insurers have been operating in a soft market for many years, as shown in Chart 1 (below). A pricing correction began in 2017 and continued into 2018. The average premium increase across all D&O and Employment Practices Liability (‘EPL’) policies masks the substantial increases seen in Side C cover for publicly listed companies in the financial sector. Notwithstanding this correction, premiums are still insufficient to offset the many prior years of rate reductions and inadequate premiums. Further premium increases are needed to generate a sustainable rate level to cover losses.

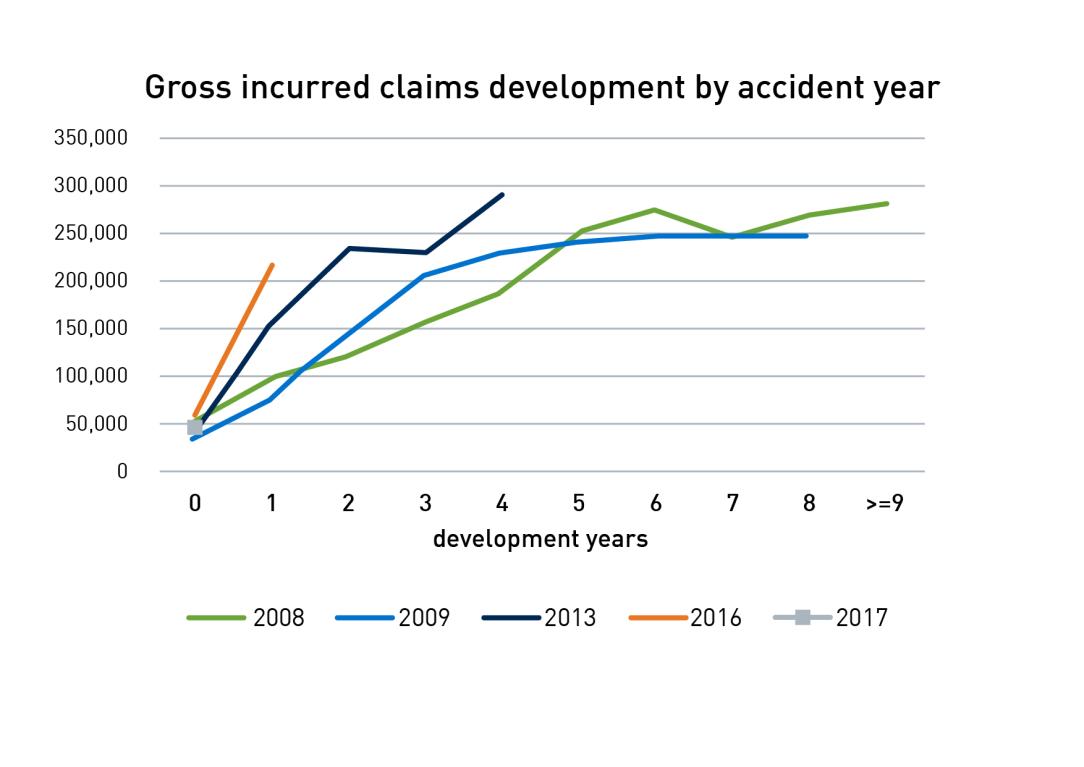

Chart 2 illustrates how D&O claims development over recent years is trending worse than the GFC-impacted years of 2008/09. Within the most recent quarterly returns, APRA has seen evidence of significant reserve strengthening by the major D&O underwriters on both a gross and net basis.

Within D&O, Side C cover has been in the spotlight over the last few months due to the increasing number of shareholder class actions. So far this year, 15 such actions have been filed, the majority in the Federal Courts. This number is somewhat misleading as some of those actions are competing class actions and the Court will ultimately decide which law firm will have conduct of the matter and the number will reduce. However, it is widely anticipated that more D&O securities class actions will be filed resulting from findings of the Royal Commission, leading to further claims being made on D&O policies.

The main D&O insurers in the Australian market tend to have extensive reinsurance protection, particularly those that have in place intragroup reinsurance arrangements with their parent organisation. In some cases these reinsurance arrangements are supported by additional local reinsurance.

Class actions

It would be easy to assume that the increase in class actions is solely due to issues emerging from the Royal Commission. This is not the case as there are other factors in play, including consumers having easier access to information through social media, requirements to bring a class action are not onerous and proceedings are being supported by an expanding number of litigation funders[3].

Earlier this year, the Australian Law Reform Commission (ALRC)[4] released a discussion paper regarding class action proceedings and litigation funding. Their final report is due to be submitted to the Federal Attorney General on 21 December 2018, and is likely to have a significant influence over how class actions are managed into the future.

What are we seeing?

In researching this article, APRA recently spoke to people across the industry, with the Claims Manager from one prominent reinsurer, observing: “The market has changed in the last 12 months, but capacity is likely to continue for those insurers who are cautious in their underwriting approach”.

In the next two to three years, they noted that “if there is no reform, it is likely the loss ratios will continue at a significant level”, but remained “hopeful the ALRC will curb the current class action trend”.

APRA has already seen adjustments in underwriting approaches, both quantitative and qualitative in nature. These include a more cautious, and disciplined underwriting approach, such as particular inquiry into an entity’s ability to meet continuous disclosure obligations, entity culture and visibility of the board. Insurers are now setting higher deductibles/higher attachment points for the coverage as well as lower limits of indemnity per risk. For global insurers operating in Australia, larger risks usually now require referral to Head Office for sign-off. Premium increases for Side C have increased by 400 per cent for large publicly listed companies and ‘Royal Commission Exclusions’ or other exclusionary language has begun to be included in contracts, in an attempt to ring fence any exposure to Royal Commission issues.

APRA’s concern with these developments is the potential for further reduced capacity in the market. This challenge for insurers is compounded by longstanding and ongoing rating pressure which could drive the premiums required to a level where the premium is cost prohibitive to the market. International groups could pull out of the Australian D&O market completely as the poor results would not be within the group risk appetite.

What is APRA doing?

Although the underlying issues putting pressure on the D&O market are outside of APRA’s influence, APRA needs to address what role and assistance it can give to the industry in facing the challenges ahead. APRA's broad focus has been on engaging with insurers to monitor how they are responding to this challenging environment for D&O.

Based on APRA's supervision of the industry, it has observed that general insurers need to:

- continue to be aware of, and understand, their potential exposures to class actions;

- have suitably experienced claims teams;

- update reserves on a timely basis; and

- monitor accumulations and reinsurance coverage for these claims.

Conclusion

APRA is not alarmed by these recent developments in D&O insurance, but continues to closely observe the market looking for potential flow-on risks to the economy and community. While D&O insurance is a relatively small part of the overall general insurance business, it has an important role to play in ensuring that company directors retain the confidence to make appropriate decisions without fearing they will be held personally liable for any adverse outcomes. Without this product, companies may find themselves unable to attract and retain board members with the skills and experience they require, potentially resulting in poorer governance and consumer outcomes.

While the industry is currently well-placed to absorb the costs of a potential increase in class action lawsuits, more needs to be done to be confident that insurers will remain willing to offer this product – and the financial protection it offers – to directors. By working together, APRA, insurers, reinsurers and industry stakeholders can all seek to ensure the ongoing and longer term viability and sustainability of D&O insurance.

Footnotes

[1] A typical D&O policy has three insuring clauses. Sides A and B provide cover to the Directors and Officers either directly to the individual (Side A) or as a reimbursement to the company for its indemnification of the individual (Side B). Side C is also known as 'entity' cover and can be triggered when a claim is made against a company by shareholders who have suffered a financial loss as a result of a company's failure to disclose material facts to the share market.

[2] Chart 1 and Chart 2. Data taken from NCPD level 2 reports. Presented with inclusion of EPL data as this is how it is aggregated by the NCPD. This data excludes Lloyd's business.

[3] Some of these funders are based overseas (UK, US and Singapore) setting up satellite offices here to take advantage of the current regime. Most securities class actions are funded in this way.

[4] The Discussion paper has focused on:

- Litigation funders requiring a license or to be subject to regulation

- If continuous disclosure obligations under the Corporations Act 2001 require review

- Clarification of the procedure when there are competing class actions

- If Plaintiff class action lawyers should be allowed to operate on a contingency fee basis.

© Copyright Australian Prudential Regulation Authority 2018