APRA Insight - Issue 2 2016

International capital comparison update

In July 2015, APRA published the Information Paper International capital comparison study (2015 study) as an important first step in addressing the Financial System Inquiry (FSI) recommendation to set capital standards such that Australian authorised deposit-taking institution (ADI) capital ratios are ‘unquestionably strong’.

In its final report, the FSI suggested that for banks to be regarded as unquestionably strong they should have capital ratios that position them in the top quartile of internationally-active banks. APRA’s 2015 study, which adjusted for differences in measurement methodology across jurisdictions and uses a number of different measures of capital strength, found that the Australian major banks were well-capitalised, but not in the top quartile of international peers.

In particular, APRA’s 2015 study found that, based on the major banks’ capital adequacy ratios at 30 June 2014, a 70 basis point (bp) increase in capital ratios would be required to position the major banks’ Common Equity Tier 1 (CET1) ratio at the international 75th percentile (i.e. the bottom of the top quartile) and that they would likely need to increase their capital adequacy ratios by a larger amount to be comfortably positioned in the top quartile over the medium to long term.

The Basel Committee on Banking Supervision (Basel Committee) recently published an updated quantitative impact study (QIS)1 including the capital ratios of internationally active banks as of 30 June 2015. Based on the same methodology used in APRA’s 2015 study and using the latest Basel QIS, APRA has recently reviewed the major banks’ relative position to their international peers. To incorporate the capital raisings undertaken by the major banks, particularly during the second half of 2015, this update is based on their capital ratios as at December 2015.

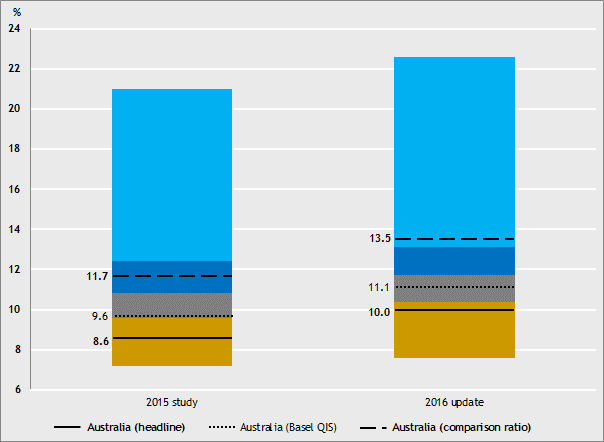

As detailed in APRA’s 2015 study, the major banks’ weighted average comparison CET1 ratio was estimated as 11.7 per cent as at June 2014. Chart 1 shows that by December 2015, this ratio had increased by 180 bps to 13.5 per cent. This increase was the result of a range of factors, but the largest single driver was the substantial capital raisings by the major banks in the latter part of 2015. The differential between the CET1 ratio under APRA’s requirements and the international comparison ratio also increased: in broad terms, the differential as at December 2015 was 350 basis points.

On a relative basis, the strengthening of the major banks’ CET1 ratios placed them, on average, at approximately 40 bps above the June 2015 Basel QIS 75th percentile of 13.1 per cent for Group 1 banks.2 The improvement in the relative position of the major banks in Chart 1 is likely to be somewhat overstated by the timing differences between the international (June 2015) and Australian (December 2015) data. On average, the 75th percentile CET1 ratio in the Basel QIS has tended to increase by approximately 25-35 basis points each half year, suggesting the 75th percentile would be somewhat higher had December 2015 QIS data been available to APRA. Nevertheless, notwithstanding this timing difference, the relative positioning of the Australian major banks’ CET1 ratios now seems broadly in line with the benchmark suggested by the FSI.

Chart 1: CET1 ratios of Basel QIS and major banks3

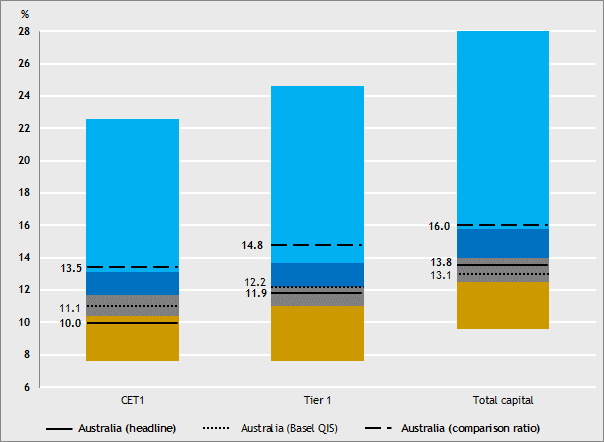

Chart 2: Capital adequacy ratios of Basel QIS (June 2015) and major banks (Dec 2015)

Furthermore, since the 2015 study the relative position of the major banks’ other weighted average comparison capital ratios have improved compared to the distribution of Basel QIS Group 1 banks.4 As shown in Chart 2, the major banks’:

- comparison Tier 1 ratio of 14.8 per cent is positioned in the top quartile as compared to the third quartile as at June 2014; and

- comparison Total capital ratio of 16 per cent is positioned at the bottom of the top quartile as compared to the median of the distribution as at June 2014.

The relative position of the major banks’ Tier 1 Leverage ratio of 5.4 per cent has also increased to a level above the median (but still below the top quartile) of the distribution of Basel QIS Group 1 banks. This compares to the banks’ position below the median in the 2015 study.

As noted above the major banks have undertaken significant capital raisings since the 2015 study, which has significantly improved their capital adequacy positon relative to international peers. That said, the trend of international peer banks strengthening their capital ratios continues. Forthcoming international policy developments will also likely mean that Australian banks need to continue to improve their capital ratios in order to at least maintain, if not improve, their relative positioning. The final design and calibration of these reforms will not be decided until around the end of 2016, and it would be prudent for Australian ADIs to continue to plan for the likelihood of strengthened capital requirements in some areas.

As detailed in the 2015 study, APRA’s analysis on the relative positioning of major bank capital ratios is intended to inform, but not determine, its approach for setting capital adequacy requirements. Recent regulatory actions (such as that applying to mortgage risk weights announced in July 2015), and the resulting improvement in the major banks’ international capital comparison, provide the necessary time for APRA to consider the full range of factors that are relevant to satisfy the FSI’s unquestionably strong recommendation. Critically this includes assessing the impact of the Basel Committee reforms as they are finalised and considering how other measures of resilience, such as liquidity, funding, asset quality, and recovery and resolution planning can assist in achieving the FSI’s objective.

APRA intends to provide further insight to these broader considerations once the Basel Committee has completed its deliberations on the international framework around the end of 2016.

1 Basel Committee, Basel III monitoring report, March 2016.

2 Basel QIS Group 1 banks comprises approximately 100 internationally active banks with Tier 1 capital of more than 3 billion Euros.

3 In Charts 1 and 2 the Australia (headline) ratios are determined under APRA’s prudential framework. The Australia (Basel QIS) ratios are derived from the Basel QIS which requires banks to report their regulatory capital base in an internationally-consistent manner. The Australia (comparison ratio) ratios are calculated using the methodology set out in the 2015 study.

4 Consistent with the 2015 study the reported Basel QIS and comparison Tier 1 and comparison Total capital adequacy ratios have not been adjusted for the impact of transitional legacy capital as this issue affects banks in most jurisdictions. The major banks’ headline Total capital ratio is higher than their Basel QIS Total capital ratio as APRA’s framework allows for phasing out of legacy capital instruments.

The Financial Claims Scheme for Authorised Deposit-taking Institutions

Deposit insurance schemes are one of the many tools Governments and financial regulators have put in place to protect depositors of banking institutions from loss in the event a bank fails. By engendering confidence in depositors that their funds are protected from loss, such tools can also contribute to financial stability in times of crisis.

In Australia, the Financial Claims Scheme (FCS), which was established by the Australian Government in 2008 in response to the global financial crisis, covers both banking institutions – authorised deposit-taking institutions (ADIs) – and general insurers. This article focusses on the operation of the FCS in relation to ADIs. The objectives of the FCS for ADIs are to:

- protect depositors of authorised deposit-taking institutions (ADIs) that are incorporated in Australia from potential loss due to the failure of these institutions;

- provide depositors with prompt access to their deposits that are protected under the FCS; and

- support the stability of the Australian financial system

How the FCS for ADIs works

In the unlikely event that a banking institution incorporated in Australia fails, the FCS can be activated by the Australian Government. Once the FCS is activated by the Government, the scheme is administered by APRA.

Under the FCS, deposits are protected up to a limit of $250,000 for each account holder at each bank, building society and credit union incorporated in Australia (and authorised by APRA). Once activated, APRA will endeavour to pay the majority of account holders their protected deposits in seven calendar days.

Industry readiness

Critical to achieving a prompt payout of protected deposits to account holders is ensuring ADIs are operationally ready – prior to any failure - to meet payment, reporting and communication requirements for the FCS.

A key component of the regulatory framework for the FCS was the implementation of Prudential Standard APS 910 Financial Claims Scheme (APS 910) in 1 July 2013. APS910 sets out the minimum requirements for locally incorporated ADIs to ensure they are adequately prepared to facilitate timely and secure access to deposits, should the FCS be activated. With the final transition period for ADIs now complete1, all ADIs are now required to be operationally ready to meet the payment, reporting and communication requirements of the FCS.

APS 910 places responsibility on each ADI to ensure it has the policies, procedures and appropriate controls in place to effectively complete an FCS payout. In particular, each ADI is required to be able, in the event the FCS is activated, to promptly send the necessary payout information to the Reserve Bank of Australia, who makes the payments on behalf of the FCS, either to the account holder’s nominated alternative account or to the account holder by cheque.

To demonstrate readiness, each ADI is required to have an appropriate internal testing regime in place. In addition, the ADI’s CEO and external auditors must annually confirm that the ADI is capable of aggregating account holder information to generate a Single Customer View (SCV), has the systems and controls in place to produce FCS payment information and generate reports, and is pre-positioned to communicate with account holders and other customers using the ADI’s normal communication channels.

In addition, APRA has performed a benchmarking review of ADI’s CEO declarations and external auditor attestations with regards compliance with APS910 for the reporting periods ending 2014 and 2015. It is important that ADI’s own assurance processes and testing practices provide the necessary evidence regarding the ability to carry out an FCS payout. APRA is using these reports to help frame the scope of further work it will undertake to provide additional assurance as to ADIs’ readiness. Key areas for further attention by APRA will involve ADIs’ reconciliation processes and controls in relation to generating the SCV, including testing practices, account aggregation methodology, and data quality (accurate contact information).

Where external auditor reports, CEO declarations or other internal testing indicates areas for improvement, APRA will require appropriate remedial action will be taken by the ADI in a timely manner. Following up on identified remedial action will be a priority focus for APRA in the reviews it plans to undertake over the next 12 months.

Reporting template

At the request of, and in consultation with, audit firms, APRA developed an APS 910 assurance report template which provides auditors with a comprehensive means of reporting on an ADI’s compliance with APS 910. At a minimum, all APS 910 assurance reports should include:

- guidance regarding the scope and timing of assurance over the reporting period;

- explicit wording regarding the report’s limitations, responsibilities of the Board and appointed auditor, and distribution limitations; and

- specific negative assurance clauses that cover the SCV data set, FCS payment instructions and reporting information, APS 910 compliance, and the operational effectiveness of associated controls.

APRA encourages the use of the audit template, and plans to engage with the audit industry to seek feedback on the work they have undertaken in this area, including any feedback on improvements that could be made to the template report.

Public awareness

In addition to APRA’s responsibility to ensure ADIs can administer the FCS on a timely basis if the Scheme is activated, APRA is also seeking to promote public awareness of the FCS both prior to and during any such event. To this end, APRA recently expanded its information for the public in relation to the FCS with a dedicated FCS website. The new website can be found at www.fcs.gov.au.

The FCS website has a two distinct purposes: firstly to provide the public with detailed information regarding on the FCS for protected depositors (and general insurance policyholders); and secondly, in the unlikely event that an FCS is declared the website will be an important channel of communication to affected customers and the wider public.

1 All ADIs were required to be compliant with the amended APS 910 by 1 July 2014, unless otherwise granted extended transition (up to 31 December 2015). A number of such extensions were granted, reflecting the individual circumstances of some institutions.

APRA's technical assistance activities in the Asia-Pacific region

Introduction

APRA’s technical assistance activities in the Asia-Pacific region support Australian ‘whole-of-Government’ initiatives that seek to improve governance in the region. Enhancements to regulatory and legal governance frameworks, and the related development of supervision capability in the region, are intended to lead to improved conduct of business and the betterment of the business environment in assisted Asia-Pacific countries.

APRA’s technical assistance programs

APRA’s technical assistance programs commenced in the Pacific in 2004 and in Indonesia in 2005. The programs aim to improve governance in the financial sector and regulatory agencies, develop financial sector regulatory architecture and build the capacity of regional prudential supervisors. Given APRA is industry-funded for its core activities, this technical assistance work is principally funded by the Department of Foreign Affairs and Trade (DFAT) under the Government Partnerships for Development (GPFD) (Pacific) and Government Partnership Fund (GPF II) (Indonesia) programs

Indonesia

The goal of APRA’s technical assistance program with Indonesia is to assist the development and implementation of a risk-based approach to supervision, drawing on and adapting APRA’s experience and systems. APRA’s program with Bank Indonesia (BI) and Otoritas Jasa Keuangan (OJK) (Financial Services Authority) consists of two work areas: Indonesian secondees and training in Australia, and ongoing strategic discussion through senior management relationships delivered in Australia and Indonesia.

Secondees to Australia are hosted in frontline, specialist risk, and data collection and/or reporting teams for periods up to six months. Since commencement in 2005, 29 secondment activities involving 66 participants have been undertaken within APRA’s Sydney and Melbourne offices, and have covered banking, insurance and superannuation supervision.

The Pacific

APRA’s technical assistance program with the Pacific is designed to deepen the supervisory capacity of Pacific participants1 in conducting risk-based supervision and in the development of their supervision framework documentation. APRA’s program with the Pacific consists of two work areas: short-term secondments similar to the Indonesian program, and on-site review training in which an APRA supervisor travels to a Pacific country for two weeks to conduct training programs with an on-site review team comprised of local and other visiting Pacific prudential regulators.

Since 2004, 33 secondments have been undertaken within the Sydney, Brisbane and Melbourne offices and 53 on-site review training programs have taken place, involving 432 participants across various Pacific jurisdictions.

BI, OJK and Pacific jurisdictions have indicated that APRA’s technical assistance programs over the past 10 years have directly assisted them in risk-based supervision capacity building, the development of their risk-rating tools and supervision framework documentation and on-site supervision processes. In Pacific jurisdictions, formal supervision training for many staff has been limited to the APRA assisted on-site and secondment program.

DFAT has commented that ‘the APRA - OJK Partnership, supported under the Government Partnerships Fund, is providing high quality technical assistance and capacity building support through policy dialogue and its internship program. The partnership is helping OJK to improve its operational capacity to build confidence in the integrity of its capital markets to encourage investor confidence and to promote investment that contributes to economic growth. This important work complements our efforts to strengthen the financial services relationship between Indonesia and Australia, particularly in the context of delivering an ambitious Indonesia-Australia Comprehensive Partnership Agreement.’

The technical assistance interaction not only provides benefits to Asia-Pacific countries, but also for APRA. International secondees at APRA not only make a valuable contribution to their host teams but also assist APRA develop useful partnerships with foreign regulators and gain a greater understanding of their financial sector, regulatory regime, supervisory approach and challenges faced. APRA also benefits from an enhanced information flow, particularly in relation to cross-border entities and other common issues. Furthermore, APRA staff are given valuable development opportunities, such as gaining experience as a trainer, mentoring junior team members, and supporting and engaging interns.

Other technical assistance activities

In addition to the above activities, APRA receives many delegation visits and enquiries from prudential regulators (particularly from developing countries and emerging nations) seeking to gain an understanding of APRA’s supervisory approaches, processes and systems.

Table 1: Overseas enquiries and delegations by region and by calendar year

| Activity | 2013 | 2013 | 2014 | 2014 | 2015 | 2015 |

|---|---|---|---|---|---|---|

| Asia-pacific2 | Rest of the World | Asia-Pacific | Rest of the World | Asia-Pacific | Rest of the World | |

| Enquires | 34 | 222 | 52 | 168 | 38 | 143 |

| Delegations3 | 43 | 57 | 33 | 60 | 29 | 30 |

APRA also supports initiatives of multilateral institutions by providing speakers to regional seminars, particularly where there is a technical assistance objective. Speaking engagements typically include the Financial Stability Institute (of the Bank of International Settlements), the Asia-Pacific Economic Cooperation (APEC) Study Centre at RMIT University, the APEC Financial Regulatory Training Initiative (FRTI), the Association of South-East Asian Nations Insurance Training and Research Institute and the South East Asian Central Banks Centre.

Funding

APRA’s ability to deliver technical assistance activities is limited by APRA’s capacity to provide these services without impacting delivery of its core business commitments. In view of this constraint, APRA pursues a targeted, limited (up to three full-time equivalent (FTE) personnel per annum) and reactive strategy for technical assistance, focussed on the Asia-Pacific region.

To ensure that use of levy funds for technical assistance purposes remains modest, APRA seeks cost recovery of at least 60 per cent of its estimated expenditure on technical assistance activities. APRA’s technical assistance programs with Indonesia and the Pacific are fully funded by DFAT (i.e. are on a full cost recovery basis). For some of the other technical assistance activities (e.g. speaking engagements), costs are recovered where it is feasible to do so.

Table 2: APRA’s technical assistance cost recovery by calendar year

| Technical assistance activity | 2013 | 2013 | 2013 | 2014 | 2014 | 2014 | 2015 | 2015 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| $’000 | % | FTE days | $’000 | % | FTE days | $’000 | % | FTE days | |

| Technical assistance costs recovered4 | 721 | 78 | 334 | 557 | 85 | 173 | 890 | 92 | 228 |

| Other technical assistance | 204 | 22 | 137 | 101 | 15 | 101 | 75 | 8 | 32 |

| Total | 925 | 100% | 471 | 658 | 100% | 274 | 965 | 100% | 260 |

Conclusion

APRA’s technical assistance programs provide a cost-effective and valued contribution to developing supervisory capacity in counterpart organisations in the Asia-Pacific region. APRA’s efforts are acknowledged as highly beneficial by regulators in the region and are valued by participants, and help make APRA a better regulator by providing many staff with valuable development opportunities.

1 Prudential regulators from the Cook Islands, Fiji, Micronesia, Papua New Guinea, Samoa, Solomon Islands, Timor-Leste, Tonga and Vanuatu.

2 Includes developing countries and Emerging Nations in the Asia-Pacific region (OECD member countries Japan and Korea are included in the Rest of the World category).

3 Includes secondments.

4 This includes technical assistance costs recovered from DFAT and other organisations (e.g. APEC Study Centre, APEC-FRTI and IMF).

Renovating the regulatory framework: A retrospective look at APRA’s prudential regulation of life and general insurers in Australia

Introduction

The prudential framework for the life and general insurance industries in Australia is the result of a great deal of reform over a number of years. Some of this change was implemented in response to the collapse of HIH Insurance - the largest corporate failure in Australia’s history – in 2001.

15 years after the HIH failure, it is worth reflecting on the reforms that have strengthened the insurance framework. APRA considers that the industry now operates within a suitably robust framework that contains prudential standards and prudential practice guides across a range of issues including governance, capital adequacy, reinsurance, outsourcing and risk management.

When APRA was formed in 1998 there were a number of challenges and opportunities for the prudential regulation of insurers. At the time, Australia relied on a prudential regime for insurers that had been largely unchanged since the Insurance Act 1973 came into effect1. In that time, there had been significant developments in corporate governance, risk measurement and business practices, however the prudential framework had not kept pace with these developments. Consultation on how Australia’s insurance prudential framework should be shaped was well underway in 2001 when the collapse of HIH occurred.

After HIH

With the collapse of HIH highlighting material weaknesses in the insurance prudential framework, comprehensive prudential standards were introduced in July 2002 following the passage of the General Insurance Reform Act 2001. This legislation provided APRA the power to issue prudential standards for general insurers and also required the improved use of auditors and actuaries. The new prudential standards imposed higher standards of governance, risk management and reinsurance management, and improved the rigour with which general insurers valued their insurance liabilities and assessed their capital adequacy.

As part of the transition to the strengthened regime, general insurers were required to seek re-authorisation if they intended to continue operating in Australia. That process, which aimed to ensure that insurers were able to operate under the revised prudential framework and were in a sound financial position, was a major step towards improved prudential outcomes in the industry.

In the following years, APRA continued to further strengthen the prudential framework for insurers. This included making enhancements to prudential standards to permit the supervision of insurance groups on a consolidated basis, and strengthening requirements for governance, the fitness and propriety of senior management, business continuity management and outsourcing.

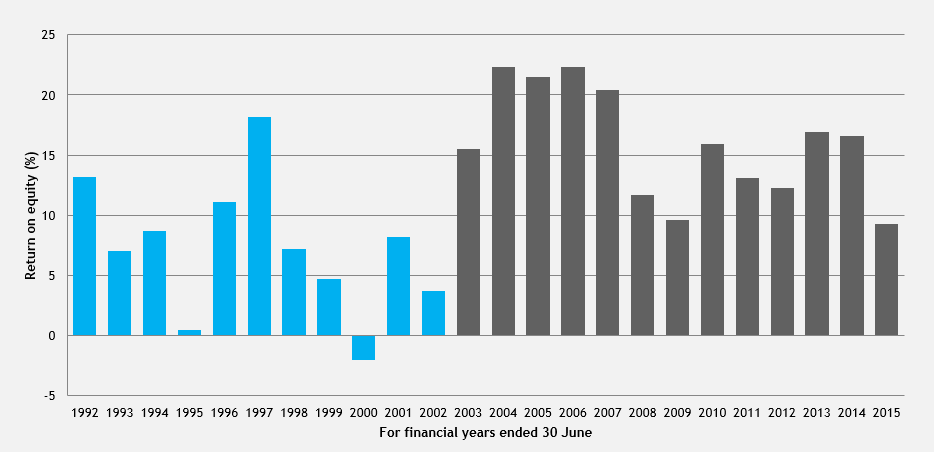

As Figure 1 shows, industry performance has improved significantly and profitability has been more stable, due to sound product pricing, improved and more consistent underwriting performance and more stable investment returns. Policyholders have ultimately benefited from a safer, more efficient and more competitive industry able to meet claims obligations as they fall due.

Figure 1: General insurance industry return on equity

Sources: Selected Statistics on the General Insurance Industry for years ended 30 June 1991 to 2002. APRA Quarterly General Insurance Performance Statistics December 2015. Statistics prior to 2003 relate to the Inside Australia business of insurers only.

Recent reforms

The most significant changes to the prudential framework in more recent times were the Life and General Insurance Capital reforms (referred to as LAGIC). This was a comprehensive review and update of the capital framework for insurers to improve the risk-sensitivity of capital requirements and to achieve better alignment across APRA-regulated industries. Engagement with the insurance industry on LAGIC commenced formally in 2009. The reforms were implemented in 2013.

With the aid of extensive industry consultation over four years, these reforms modernised, harmonised and further strengthened the insurance prudential framework in Australia. While the earlier post-HIH changes strengthened capital standards for general insurers, the LAGIC reforms occurred in that wake of Australia’s experience through a number of large-scale natural disasters and the global financial crisis, which highlighted a number of areas in which the capital framework for both life and general insurers lacked risk sensitivity.

For example, a number of natural disasters in Australia exposed gaps in the adequacy of the general insurance capital standards to deal with extreme events or multiple large losses in any one year. The reforms ensured that all material risks, including asset/liability mismatch, asset concentration and operational risks, were adequately addressed within the capital standards.

Further, the experience during the global financial crisis, particularly overseas, showed that certain types of capital instruments did not behave as expected in times of stress. This experience was shared with the banking industry and APRA responded by raising the quality of capital in the insurance and banking industries in a harmonised manner.

Focus in 2016

Over time, APRA has placed considerable focus on not only improving the prudential framework for insurers, but also on strengthening the effectiveness of its supervision. Having learned lessons through the experience of the HIH collapse and adopted the recommendations from both government and internal reviews, APRA has developed and maintained a proactive and, where warranted, interventionist supervisory approach. The success of this approach is necessarily underpinned by APRA having a clear mandate and appropriate resourcing, both of which were bolstered in the aftermath of HIH.

Having made significant improvements to the prudential framework and supervisory approach, APRA maintains an eye to refinements that can be made and new risks that may emerge. In 2016, our focus will be on undertaking a review of the role of actuarial advice for insurers. In addition, a heightened supervisory focus on culture is also being taken for all APRA-regulated entities.

It is clear that the prudential framework and supervision approach towards Australia’s insurance sector has evolved considerably over the past 15 years – providing greater protection for millions of policy holders while at the same time maintaining a dynamic and competitive insurance sector.

1 In contrast, life insurance capital requirements had been overhauled relatively recently, with the introduction of the Life Insurance Act 1995.