APRA 2021-25 Corporate Plan

Chair’s foreword

2020 will be remembered as a year of disaster and disruption, with the impacts from natural disasters including devastating bushfires and floods and the COVID-19 global pandemic felt right across the Australian community.

There is no doubt Australia has demonstrated great strength and resilience in responding to these events. Australia’s economy rebounded faster than originally expected to the adverse events of 2020, aided by supportive policy settings, and the financial system has emerged from a turbulent year in good health. The challenges and uncertainty created by the pandemic remain, but the financial system appears well-equipped to handle them.

In looking to the future and setting its 2021 – 2025 Corporate Plan, APRA will build on these strong foundations. In its core prudential supervision role, APRA remains committed to ‘protecting the Australian community today’. In particular, APRA will continue to actively support COVID-19 response activities where needed, within its broader efforts to promote a stable, efficient and competitive financial system that the Australian community can have confidence in. But being a forward-looking supervisor, APRA must also ‘prepare for tomorrow’. The financial landscape is evolving rapidly, particularly in response to the impacts of technology and digitisation that are changing society more broadly. APRA will therefore work in close partnership with its regulatory colleagues and other key stakeholders, both domestically and internationally, to make sure that the prudential architecture remains fit for purpose into the future.

APRA is also committed to building on the learnings and significant momentum gained last year to provide a flexible and adaptive workplace for its staff. APRA will continue to invest in enabling technologies and infrastructure, support flexible ways of working, and empower its employees to perform at their very best to deliver on APRA’s purpose and, in doing so, serve the needs of the Australian community.

It is with this backdrop that, as the accountable authority of APRA, I present APRA’s 2021 – 2025 Corporate Plan, as required under paragraph 35(1)(b) of the Public Governance, Performance and Accountability Act 2013. I will report on progress against this plan in APRA’s 2021–2022 Annual Report.

Wayne Byres

Chair

Executive summary

The challenges of 2020 were unprecedented, with natural disasters including devastating bushfires and floods domestically and the emergence of the COVID–19 pandemic globally. In an environment of severe economic stress, APRA’s 2020–2024 Corporate Plan narrowed the organisation’s short-term priorities to focus on three key core objectives:

- reinforcing the safety and soundness of APRA-regulated institutions;

- fostering their operational resilience during a period of significant disruption; and

- enhancing contingency plans to address the increasing risk of failure of one or more APRA-regulated institutions.

In looking to the future, COVID-19 remains a dominant influence on the economic and financial environment. But it is far from the only important influence. As a forward-looking prudential supervisor, APRA has sought to update its Corporate Plan with a wider perspective acknowledging that, while the pandemic is yet to be overcome, there are many other factors that are influencing the shape and risk profile of the financial system, and to which APRA needs to respond.

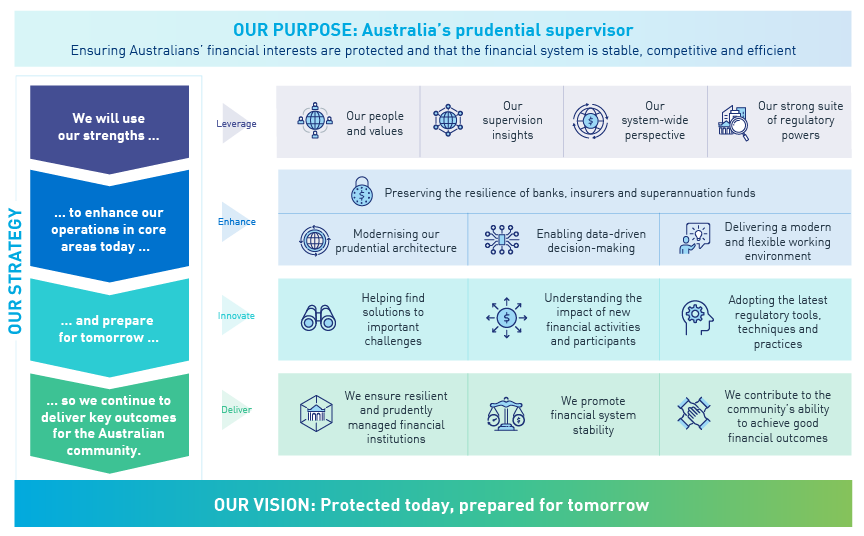

At their heart, APRA’s refreshed strategic priorities remain anchored in its purpose:

Ensuring Australians’ financial interests are protected and the financial system is stable, competitive and efficient.

To fulfil this purpose, APRA’s 2021–2025 Corporate Plan is focused on two strategic themes: ‘protected today’ and ‘prepared for tomorrow’.

Protected today

A prerequisite for economic activity and prosperity is that Australians have confidence in the safety and stability of the financial system. APRA must therefore continue to direct a large proportion of its time and resources to its core role of preserving the financial and operational resilience of Australia’s banks, insurers and superannuation funds, so that Australians’ financial interests are protected today. It will do this by:

- targeting regulatory activities in a risk-based manner;

- modernising the prudential architecture to ensure it remains fit for purpose;

- continuing to drive greater data-driven decision-making; and

- delivering a modern and flexible working environment and maintaining a high-calibre workforce capable of responding to new challenges as they arise.

Prepared for tomorrow

The shape and structure of the financial system is rapidly evolving. In response, over the 2021 – 2025 planning horizon, APRA will work today to ensure the Australian financial system is prepared for tomorrow by:

- dedicating regulatory attention to the evolving financial landscape in Australia, including understanding the impact of new financial activities and participants;

- helping to find solutions to important challenges, such as: superannuation retirement income products; insurance accessibility and affordability for Australians; and the financial risks associated with climate change; and

- ensuring it continues to adopt the latest regulatory tools, techniques and practices.

Building on strengths

To be successful in its objectives, APRA will leverage its distinctive strengths:

- its people and values;

- its supervision insights,

- its system-wide perspective; and

- its strong suite of regulatory powers.

Further detail on APRA’s purpose, vision, strategic outcomes and priorities is provided below.

APRA’s strategic priorities

APRA’s purpose and vision

APRA’s Corporate Plan 2021-25 sets out how APRA will seek to fulfil its purpose, which is derived from its founding legislation1:

APRA is the financial sector’s prudential supervisor. Its purpose is to ensure Australians’ financial interests are protected and the financial system is stable, competitive and efficient.

APRA seeks to achieve this purpose by, first and foremost, employing a supervision-led approach. APRA undertakes prudential supervision with a view to (i) identifying risks and vulnerabilities within the financial system that might jeopardise its purpose, and (ii) acting to ensure those risks and vulnerabilities are mitigated. By employing a supervision-led approach, APRA seeks to be forward-looking, risk-based, and outcomes focused – addressing potential problems before they adversely impact those APRA is tasked to protect. A supervision-led approach also assists in minimising regulatory burden and facilitating competition and innovation.

Reflecting this forward-looking philosophy, APRA’s vision is focused on two strategic themes: ‘protected today, prepared for tomorrow’. These themes are designed to drive organisational focus on delivering APRA’s purpose and key outcomes for the Australian community so as to:

- ensure resilient and prudently managed financial institutions;

- promote the stability of the Australian financial system; and

- contribute to the community’s ability to achieve good financial outcomes.

In seeking to deliver these outcomes, APRA will leverage its core strengths:

- its people and values. APRA has a highly skilled, committed and experienced workforce, with strong clarity of purpose and clear values that the organisation seeks to uphold at all times.

- its supervision insights. As a supervision-led organisation with close and continuous engagement with regulated institutions, APRA has unique insights into the risks and vulnerabilities within financial institutions.

- its system-wide perspective. By virtue of its ability to look both deeply into institutions as well as aggregate these views across the financial sector, APRA is able to bring a system-wide perspective to the understanding the nature of risks and vulnerabilities within the financial system as a whole.

- its strong suite of regulatory powers. Recent legislative changes have strengthened APRA’s powers in a number of important areas, meaning APRA supervisors are well-equipped to address risks and enforce change where that is required.

APRA’s strategic priorities

Protected today

APRA will continue to direct the majority of time and resources to its core role of preserving the financial and operational resilience of Australia’s banks, insurers and superannuation funds, so that Australians’ financial interests are protected today.

APRA will do this by:

- targeting supervisory activities to those issues of greatest risk;

- modernising the prudential architecture to ensure it remains fit for purpose; and

- driving greater data-driven decision-making.

Preserve the resilience of banks, insurers and superannuation funds

APRA will enhanceits operations by harnessing its newly established Supervisory Risk and Intensity (SRI) model to derive greater supervisory insights and intelligence, and proactively keep pace and respond to key risks and vulnerabilities. For this strategic priority, APRA will target its activities in the key areas outlined below and use its strong suite of regulatory powers where necessary to achieve desired outcomes.

Banking

- Underpin industry capital strength by completing the implementation of the Basel 3/’unquestionably strong’ capital reforms.

- Maintain scrutiny of credit risk and liquidity risk at an individual bank and systemic level - with ongoing focus on negative effects of the COVID-19 pandemic.

- Ensure that banks are operationally resilient, and support the ongoing development of credible recovery plans by banks.

- Monitor banking industry cohorts by adopting targeted supervisory strategies where appropriate to foster competition and viability.

Insurance

- Ensure that insurers strengthen governance and risk management practices, including in response to the lessons learned from COVID-19.

- Work with Government, other Commonwealth agencies and industry stakeholders to address accessibility and affordability of insurance products for Australians.

- Promote the sustainability of insurance products for the long-term benefit of consumers, including continued heightened attention on business lines such as individual disability income insurance and insurance in superannuation.

- Strengthen APRA’s resolution and crisis management capability and ensure credible recovery plans are in place across the Australian insurance sector, prioritising insurers facing higher risks and those of greater systemic importance.

Superannuation

- Drive the implementation of Government’s Your Future, Your Super reforms and act on superannuation entities not meeting the new obligations.

- Ensure the superannuation industry rectifies sub-standard practices by strengthening prudential standards focused on:

o fitness and governance of superannuation trustees and conflicts of interest;

o risk management and investment governance;

o operational risk management including outsourcing and business continuity; and

o strategic planning and member outcomes.

- Ensure the superannuation industry eradicates unacceptable product performance by:

o conducting the new annual performance test under the Your Future, Your Super reforms;

o publishing performance-based heatmaps to support transparency and accountability for other areas of performance;

o facilitating the resolution/exit of underperforming superannuation products; and

o using prudential powers to take action against superannuation trustees where warranted.

- Continue to enhance APRA’s data collections to ensure appropriate data is available to monitor performance of all superannuation products.

Cyber resilience across the Australian financial system

APRA will continue its focus on strengthening operational and technological resilience across Australia’s financial system. APRA will deliver on its 2020-2024 cyber security strategy focused on strengthening cyber resilience today and being prepared for tomorrow’s cyber challenges, including:

- Ensuring expectations for baseline cyber controls, hygiene and cyber-attack protocols are in place, along with appropriate recovery plans that minimise the disruption to the operation of critical functions in the event of an attack.

- Enabling boards and executives to oversee and direct correction of cyber exposures.

- Fostering the maturation of supplier cyber assessment and assurance by rectifying weak links within the broader financial ecosystem and supply chain.

- Working closely with Council of Financial Regulators (CFR) agencies to harmonise regulation and enhance supervision of cyber across the financial system using a variety of mechanisms to identify weaknesses including data collection and analysis.

This is an enduring strategic priority for APRA with multi-year programs of work already in progress.

Transform governance, culture, remuneration and accountability (GCRA) across banks, insurers and superannuation trustees

APRA will continue to give attention to strengthening (i) governance frameworks and processes; (ii) a risk culture that supports effective risk management practices; (iii) remuneration arrangements that reflect a holistic assessment of performance and risk management, and reduce the incentive for misconduct; and (iv) clear accountability (individually and collectively) for outcomes achieved across Australia’s banks, insurers and superannuation trustees. To support these objectives, APRA will continue to deliver on its GCRA work program with concentrated attention in the following areas:

- Finalising and implementing Prudential Standard CPS 511 Remuneration and strengthening Prudential Standards CPS 220 Risk management; CPS 510 Governance; and CPS 520 Fit and proper;

- Rolling out APRA’s new risk culture survey to benchmark and assess trends in risk culture across regulated industries;

- Improving accountability by working with Government and ASIC to extend the Financial Accountability Regime across all banks, insurers and superannuation trustees;

- Following up and evaluating regulated entity actions in response to issues identified from risk governance self-assessments and regular prudential engagements, including working to close issues currently resulting in capital overlays or enforceable undertakings; and

- Sharing more frequent GCRA insights with external stakeholders.

This is an enduring strategic priority for APRA with key work streams already in progress.

Modernise the prudential architecture

As risks in the financial system have changed and evolved, the challenges facing the financial services industry have broadened and become more complex. To address new risks and strengthen resilience, APRA has responded by enhancing existing and creating new prudential standards and guidance where needed. In the past year, for example, APRA has lifted standards for remuneration practices, instituted changes in its approach to licencing new entrants, and issued new draft guidance on financial risks associated with climate change.

Looking ahead, APRA will need to continue to adapt the prudential architecture as risks to the system continue to evolve, the digitisation of finance accelerates, new participants enter the industry and business models change. Within this context, APRA will enhance its operations by initiating a new strategic priority focused on modernising the prudential architecture for a digital world. Over the 2021–2025 plan horizon, APRA will:

- Modernise the prudential framework to make the prudential standards and guidance more accessible for industry, reduce burden and encourage innovation in regtech and suptech.

- Build capabilities to support digitisation and better regulation.

- Adapt the architecture to cater for new and emerging risks from the evolving global and domestic financial landscape.

The ultimate goal is to build a modern and adaptable prudential framework that provides a platform to maintain system stability and support innovation, in a changing operating environment.

Enabling data-driven decision-making

Technology and data are key to enabling effective operations and decision-making for the entities that APRA supervises. To support data-driven decisions by internal and external stakeholders and as a further step towards better regulation, APRA will enhance its operations by continuing to invest in and embed data as a core enabler for achieving its purpose and strategy. To achieve this strategic priority, in the short-term APRA will:

- Deliver APRA’s new data collection infrastructure, ‘APRA Connect’2.

- Accelerate migration of continuing data collections from APRA’s legacy system (D2A) to the APRA Connect platform across all regulated industries.

- Implement new data collections designed to collect more granular data which will meet APRA’s future data needs as well as better manage the reporting burden on regulated industries.

- Continue to pilot and apply applications of data science analytics techniques.

- Continue to work with other Government agencies on opportunities to collect data once and share.

Over the longer-term, APRA intends to decommission D2A and further develop advanced analytical capabilities. APRA also plans to modernise its data publications by investing in tools to support more extensive external data sharing both publicly and between Government agencies.

Prepared for tomorrow

Over the 2021–2025 plan horizon, APRA will seek to ensure the Australian financial system is prepared for tomorrow by:

- Dedicating regulatory attention to the evolving financial landscape in Australia including understanding the impact of new financial activities and participants.

- Helping to find solutions to current challenges, such as: superannuation retirement income products; insurance accessibility and affordability for Australians; and the financial risks associated with climate change.

- Adopting the latest regulatory tools, techniques and practices.

Understanding the impact of new financial activities and participants

The global financial landscape is evolving at an increasing pace. New business models are emerging, new technology is being developed and deployed, and the digitisation of finance is accelerating. This change is testing traditional regulatory boundaries and approaches worldwide. Australia’s prudential architecture will need to evolve and adapt: new and existing players will need the flexibility to innovate and grow, within a regulatory framework that continues to safeguard financial safety and system stability.

Some of the emerging trends in innovation may represent structural shifts in the market and some may not. In any scenario, regulatory boundaries will need to be considered, and adjusted where necessary to provide the appropriate guardrails to support sustainable financial innovation. Over the 2021–2025 plan horizon, APRA will leverage its system-wide perspective to consider the implications of the evolving financial landscape in Australia by:

- Scanning the horizon to better understand, and articulate its position, on the impact of new financial activities and emerging business models, and the wider implications for system safety and stability that the prudential architecture will need to address.

- Engage closely with peer regulatory agencies domestically and internationally, particularly on regulatory perimeter and cross-border issues to ensure there are appropriate frameworks in place for Australia.

- Identify opportunities offered by new technology to improve the way APRA and regulated industries operate, including the usage of suptech deployed by APRA and regtech deployed by regulated entities.

Help to find solutions to important challenges

Superannuation retirement income products

APRA will continue to work with Government, other Commonwealth agencies and industry stakeholders to promote and deliver high quality retirement income outcomes for Australians. APRA will leverage its system-wide perspective to pursue the development and implementation of solutions to retirement income challenges and ultimately achieve improved outcomes for retirees as part of a high performing superannuation system.

Insurance accessibility and affordability for Australians

APRA will leverage its supervision insights and system-wide perspective to provide expert advice on the nature and extent of accessibility and affordability issues and the risks that exacerbate these challenges. APRA will proactively seek to address issues in the affordability and availability of insurance across the general, life and private health insurance sectors, to improve outcomes for Australians. This will require working with key stakeholders in Government, other regulatory agencies and the insurance industry to achieve an appropriate balance between the financial health of insurers and access to affordable and well-designed insurance for consumers.

Financial risks associated with climate change

APRA will continue its work on improving the understanding and managing of financial risks associated with climate change, to facilitate well-informed decision-making by regulated entities. This includes finalising prudential guidance, conducting climate vulnerability assessments, data gathering and further engagement with Council of Financial Regulator (CFR) agencies, industry bodies, research organisations and global regulatory peers.

Adopting the latest regulatory tools, techniques and practices

APRA will continue to seek to adopt the latest regulatory tools, techniques and practices, including in areas such as specialist regulatory services, enforcement actions, transparency and resolution, to influence and enable the achievement of prudential outcomes.

Making it happen

To support the achievement of APRA’s strategic priorities and the associated outcomes for regulated entities, the financial system and the Australian community, APRA needs to maintain a high-calibre workforce, underpinned by APRA’s Values (Integrity, Collaboration, Accountability, Respect and Excellence), capable of responding to new challenges as they arise.

As a key enabler, APRA is aiming to deliver a modern and flexible working environment to support organisational empowerment and excellence and mobilisation for change.

Delivering a modern and flexible working environment

Organisational empowerment and excellence

Building on the response to COVID-19, APRA will continue its strong focus on delivering a modern and flexible working environment for its staff by:

- Providing an inclusive and diverse workplace culture where every person feels they belong and are valued and respected, supported by the rollout of APRA’s refreshed Inclusion and Diversity strategy.

- Investing in its hybrid ways of working, underpinned by contemporary management practices, reliable technologies and adaptive facilities3.

- Improving its operational effectiveness and striving for excellence and better regulation by undertaking a strategic review of APRA’s core functions to identify and act on opportunities for improvement and establish enhanced frameworks for repeatable decision-making, improved tools to measure and promote enhanced productivity, and processes for continuous improvement.

Mobilisation for change

APRA will identify opportunities to enhance its capabilities with a view to successful delivery of APRA’s 2021–2025 Corporate Plan by:

- Forming additional strategic partnerships and engaging external strategic advisors and experts in selected areas.

- Strengthening and embedding portfolio management capabilities to deliver on APRA’s strategic portfolio of work; and continuing to mature project management disciplines to ensure APRA optimises the use of available resources and capabilities coupled with appropriate governance and oversight.

Footnotes:

1. APRA’s purpose is formally set out in s8 of the Australian Prudential Regulation Authority Act 1998

2. APRA Connect will go live in September 2021, delivering baseline infrastructure to support APRA’s superannuation data transformation program, and will be progressively rolled out across all regulated industries.

3. Supporting the effectiveness and efficiency of APRA employees working both in the office and remotely, and responding to changes in the external environment with minimal operational disruption.

Appendix A: APRA’s operating context

APRA has taken the following external and internal environmental factors and co-operation elements into consideration in setting its 2021–2025 Corporate Plan, together with key risks included in Appendix B: APRA’s risk management.

External environment factors

Community and Government expectations

- The community expects APRA to ensure Australians’ financial interests are protected and the financial system is stable, competitive and efficient.

- The Australian community expects APRA to work collaboratively with the Government, other Commonwealth agencies and industry stakeholders to address shared issues in the public interest.

- The Australian Government’s expectations of APRA are set out in APRA’s Statement of Expectations4 and Statement of Intent5.

- The Government expects APRA to, in particular, support it’s deregulation agenda . APRA will contribute to the deregulation agenda6 in four key areas:

o modernising the prudential architecture to ensure it remains fit for purpose, and reduces regulatory burden;

o rolling out ‘APRA Connect’ across regulated industries, to reduce reporting burden;

o undertaking a strategic review of APRA’s core functions to identify and act on opportunities for regulatory improvement; and

o applying the principles of best practice outlined in the Regulator Performance Guide effective July 2021.

COVID-19 pandemic

- COVID-19 continues to impact the Australian and global economy. Uncertainty remains with respect to new virus strains, second and third waves, vaccine rollout and efficacy. A number of economies are continuing to experience periodic shut-downs and border closures.

- In Australia, there are risks to the domestic recovery from slow global growth; the success of the vaccine rollout; the withdrawal of monetary, fiscal and regulatory support; and periodic/prolonged shut-downs.

Evolving financial landscape (domestic and international)

- The future of financial services (including the nature of credit) continues to evolve driven by innovation, technology advancements, open data and disintermediation of the payments value chain.

- New entrants, platforms, channels, products and services, and use of outsourcing are gaining momentum and evolving the competitive landscape as alternatives to traditional offerings.

- New forms of digital currencies, wallets, stored value and payment methods are challenging the role of financial institutions as intermediaries and increasing access, speed and ease of fund transfers.

- Data transformation is rapidly accelerating with greater use of Artificial Intelligence (AI) and technology enabling quicker, more automated, and assisted decision-making.

- Consumers today are empowered with greater choice. There is an increasing preference towards digital modes of delivery and consumption of financial services.

Industry-specific factors

Cross industry

- Cyber threats continue to be a material prudential risk, with increasing frequency and sophistication of cyber-attacks having the potential to create significant harms to the Australian financial system.

- The transformation of governance, culture, remuneration and accountability (GCRA) continues to be a focus for APRA across all regulated sectors.

- APRA continues its work with regulated industries on assessing and managing the financial risks associated with climate change.

Australia’s banking industry

- The Australian banking industry continues to be resilient.

- Authorised deposit-taking institutions (ADIs) are well capitalised and funded; in aggregate, profitability and asset quality are strong and stable.

- Low borrowing costs are contributing to strong housing price growth. APRA and other members of the Council of Financial Regulators (CFR) continue to monitor associated risk factors.

- Mergers within the banking industry will continue, reflecting sustainability challenges for some ADI business models.

Australia’s insurance industry

General insurance

- The Australian general insurance industry remains well capitalised.

- Exposure to business interruption (BI) insurance losses remains a key risk in the short-to-medium-term, as well as generating lessons learnt that warrant consideration across other business lines.

- The accessibility and affordability of insurance for parts of the Australian community pose challenges, and without mitigating action are likely to be exacerbated by a variety of factors including increasing natural catastrophe events.

Life insurance and friendly societies

- The Australian life insurance industry remains resilient from a capital perspective although the industry continues to be challenged by poor profitability as a result of product sustainability issues.

- The Treasury-led review will assist in addressing legacy life insurance product concerns and the review of quality of advice is likely to support enhanced consumer outcomes.

- Friendly societies pose no immediate concern from a capital perspective, although there are vulnerabilities such as the low interest rate environment and weaker consumer demand for products.

Private health insurance

- Australia’s private health insurance industry continues to face sustainability challenges driven by ageing membership and affordability issues including claims costs rising faster than premiums.

- COVID-19 has necessitated the establishment of a Deferred Claims Liability (DCL) – money set aside as a contingency against the likelihood that cancelled or postponed treatments would be carried out at a later date. The likely pattern of future claims remains clouded by the sporadic need for ongoing lockdowns in different parts of Australia.

Australia’s superannuation industry

- The Australian superannuation industry has recovered faster from COVID-19 than initially expected, with improvements in underlying business and market conditions leading to year of strong returns to members in 2020/21.

- There remain pockets of poor superannuation product performance, including sustained underperformance and high fees and costs.

- APRA will need to devote considerable resources to implementing the Government’s important Your Future, Your Super reforms, which set higher standards for trustees, and provide APRA with new tools to deal with underperformance.

Internal environment factors

Resources and funding

- APRA is funded largely through levies on industries regulated by APRA. A small number of activities are not levy-funded (costs are recovered by user charges or Government funding.

- APRA developed its 2021–2025 Corporate Plan based on the approved funding in the most recent Portfolio Budget Statement (PBS)7. APRA’s budgeted average staffing level increased from 738 in 2019–20 to 820 in 2021–22 in the October 2020 budget. This increase was to respond to heightened risks within the Australian financial system as a result of the pandemic.

- The 2021–22 Budget included additional funding for a further 9 staff for APRA to support implementation of the Government’s Your Future, Your Super policy agenda.

Workforce

- To be successful, APRA needs to maintain a high-calibre workforce capable of responding to new challenges as they arise. The shape of the workforce will need to adapt and evolve to the changing demands on the organisation.

- APRA continues to provide a flexible and adaptive workplace for its employees by promoting hybrid ways of working (ie working patterns that involve a mix of working remotely and within APRA’s offices).

- APRA strives to provide an inclusive workplace, supported by a refreshed Inclusion and Diversity strategy.

- APRA will continue to regularly assess employee sentiment and well-being to identify opportunities for enhancement.

Technology and infrastructure

- APRA has accelerated investment in its information and communications technology (ICT) capabilities. APRA will continue this investment by supporting a hybrid cloud configuration; enhancing its network infrastructure and application platforms; upgrading technology in its offices and end user devices; and implementing controls to mitigate IT/cyber risks.

- APRA will continue to invest in flexible workspaces in all APRA offices to support hybrid working arrangements and optimise productivity and collaboration.

Co-operation with others

APRA continues to contribute to COVID-19 whole-of-government response activities, within its broader efforts to promote a stable, efficient and competitive financial system. APRA is a member of the Council of Financial Regulators (CFR)8, the primary coordinating body for Australia’s main financial sector authorities. The CFR also includes the Reserve Bank of Australia (RBA), the Australian Securities and Investments Commission (ASIC) and the Treasury.

APRA works collaboratively with other domestic and international regulators by contributing to shared regulatory outcomes, minimising duplication of activities and regulatory burden.

APRA has established Memoranda of Understanding (MoUs) and Letters of Arrangement with many domestic and international agencies to provide a formal framework of cooperation and exchange of information9.

Footnotes:

4.Statement of expectations 2018 | APRA

5. Statement of intent - September 2018 | APRA

6. https://deregulation.pmc.gov.au/about

7. https://treasury.gov.au/publication/portfolio-budget-statements-2020-21

9. MoU’s are available on APRA’s website.

Appendix B: APRA’s risk management

The delivery of APRA’s purpose and strategic priorities relies on effective risk management underpinned by a strong risk culture; clear governance and accountability mechanisms; and sustainable integration of risk management practices embedded across the organisation. APRA’s system of risk oversight, management and internal controls are aligned with Section 16 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), including the Commonwealth Risk Management Policy.

Governance

- APRA’s enterprise risk profile is primarily overseen by the following governance committees:

o Executive Board Risk (EBR);

o APRA’s Executive Committee (ExCo); and;

o APRA’s Audit and Risk Committee (ARC).

- EBR reviews, approves and oversees the operation of APRA’s Enterprise Risk Management Framework (ERMF), and monitors APRA’s risk profile to ensure that risks are being managed within APRA’s stated risk appetite, or measures are being taken to bring risks back within appetite.

- ExCo discusses and provides direction on the operational elements relating to APRA’s enterprise risk profile and ensures sufficient management attention is given to APRA’s higher-rated risks, including monitoring the progress of remedial actions.

- ARC provides an independent lens on the operation of APRA’s ERMF, including the oversight provided by the EBR.

- APRA’s Director of Strategy & Chief Risk Officer provides regular reporting to APRA’s EBR, ExCo and ARC regarding APRA’s key risks (including risks outside of appetite); material breaches or incidents; and non-compliance with, or material deviation from, APRA’s ERMF.

Framework

- The ERMF enables APRA to appropriately identify, assess, manage, and report the key risks relating to the delivery of APRA’s mandate.

- The ERMF comprises a Risk Appetite Statement (RAS); Risk Management Strategy; Enterprise Risk Management Policy; Reportable Incident & Escalation Standards; Compliance Management Policy; Business Continuity Management Framework; and Fraud and Public Interest Disclosure Policies.

- In addition to APRA’s centralised Risk Management and Compliance team that administers the ERMF, APRA’s Internal Audit function independently evaluates the effectiveness of internal controls, risk management and governance processes throughout APRA. Internal Audit also provides independent challenge and escalation where required.

Key risks

A description of APRA’s key risks and mitigating actions are outlined below, together with their connection with APRA’s core functions, capabilities and strategic priorities. The key risks broadly align with APRA’s RAS.

| Key risk focus | Mitigating actions | APRA's core function, capability, strategic priority |

|---|---|---|

| Risk of a weak or poorly designed prudential framework |

| Policy (function); Modernise the prudential architecture (strategic priority) |

| Risk of inadequate supervisory practices |

| Supervision (function); Preserve the resilience of banks, insurers and superannuation funds (strategic priority) |

| Risk of inadequate resolution capability |

| Resolution (function; and strategic priority in APRA’s previous Corporate Plans) |

| Risk of failing to maintain strong analytical capabilities and structured frameworks for decision making |

| Risk intelligence and frameworks (capability); Enabling data-driven decision-making (strategic priority) |

| Risk of inadequate skills, expertise, experience or organisational culture |

| People and culture (capability); Delivering a modern and flexible working environment (strategic priority) |

| Risk of failing to maintain robust and efficient practices, systems and premises |

| Organisational Effectiveness and Infrastructure (capability); Delivering a modern and flexible working environment (strategic priority) |

Appendix C: APRA’s key performance measures

Performance measurement at APRA takes into consideration the Public Governance, Performance and Accountability Act 2013, the associated PGPA Rule and guidance together with the recently released Regulator Performance Guide (RPG) outlining the principles of best practice that underpin the Government’s expectations of regulators and their performance.

A mix of qualitative and quantitative performance measures is used to monitor APRA’s ability to achieve its purpose. APRA is evolving from evaluating its performance based on activities and outputs to the measurement of outcomes including establishing performance targets where appropriate. APRA’s performance against its 2021–2025 Corporate Plan including the key performance measures outlined below will be reported in APRA’s 2021–22 Annual Report supplemented by qualitative narrative, case examples and other quantitative information to provide a cohesive picture of performance.

Key result areas

Strategic priorities

| Key performance measure | Performance target10 |

|---|---|

| Performing entity ratio; Money protection ratio | Low incidence of failure11 |

| Capital ratios for ADIs and insurers | Above minimum prudential requirements |

| Reduction in the number of: • superannuation members exposed to unsustainable funds; • funds with sub-standard practices; • MySuper and Choice superannuation members in high fee, poor performing offerings. | Measured from baseline at beginning of period |

| Deliverables achieved in line with APRA’s approved strategic programs of work | Key milestones achieved within planned timeframes |

Continuous improvement and building trust*

| Key performance measure | Performance target10 |

|---|---|

| Recommendations from independent reviews addressed during the reporting period | Closure within committed timeframes |

| Number of changes made to the prudential framework and level of compliance with Office of Best Practice Requirements (OBPR) requirements during the reporting period | 100% OBPR compliance |

| Results from specified questions from APRA’s latest biennial stakeholder survey. | >=80% of APRA’s stakeholders agree |

Risk-based and data-driven*

| Key performance measure | Performance target10 |

|---|---|

| APRA is primarily risk-based in its supervision; stakeholder view on the balance between regulatory burden and benefit. | >=80% of APRA’s stakeholders agree |

| Other results from specified questions from APRA’s latest biennial stakeholder survey. | >=80% of APRA’s stakeholders agree |

Collaboration and engagement*

| Key performance measure | Performance target10 |

|---|---|

| APRA’s supervision and policy priorities are transparent, and well known in advance by relevant stakeholders | At least annual review of APRA’s supervision and policy priorities |

| Results from specified questions of relevance from APRA’s latest biennial stakeholder survey. | >=80% of APRA’s stakeholders agree |

| Services are delivered in line with APRA’s service charter (once re-published in 2021) | Service level targets achieved |

Operational/administration efficiency

| Key performance measure | Performance target10 |

|---|---|

| Actual versus budget for the reporting period | Within budget |

| Percentage of Financial Claims Scheme (FCS) payments paid to account holders within seven days of an FCS declaration; number of outstanding claims in the event of an FCS declaration | 100% for ADIs |

Notes

Data sources: Include APRA’s management information systems; prudential returns submitted by regulated entities; APRA’s internal performance reports; APRA’s SRI model; APRA’s superannuation heatmaps; outcomes of business performance tests for superannuation; APRA’s latest biennial stakeholder survey; APRA and CFR website; APRA’s financials; collated qualitative/ quantitative information and case examples.

As noted above, APRA will source additional qualitative and quantitative information and case examples in addition to the key performance measures outlined above to provide a cohesive picture of performance against APRA’s 2021-2025 Corporate Plan.

Methodology: Included in - APRA’s internal procedures; APRA’s reporting form instructions published on its website; APRA’s internal performance reports; % of stakeholders that agree or strongly agree/ total stakeholder responses; actual v budget; APRA’s published Service Charter; manual compilation.

* RPF best practice principle.

Footnotes:

10. Performance targets apply to the full period covered by APRA’s 2021–2025 Corporate Plan.

11. APRA seeks to maintain a low incidence of failure of financial institutions while not unnecessarily hindering efficiency, competition or otherwise impeding the competitive neutrality or contestability of the financial system. APRA aims to identify likely failures early enough so that corrective action can be promptly initiated or orderly exit achieved.