APRA’s new digital Prudential Handbook

Over the last few years, APRA has been progressing a strategic initiative to modernise the prudential architecture (MPA). This has been a programme of initiatives designed to make the prudential framework – our standards and guidance – simpler, clearer, and more adaptable.1

The programme has involved:

- better regulation – improving the design of the framework, which is now structured in clear pillars, and rationalising and consolidating standards and guidance where it makes sense to do so;

- a digital first approach – exploring how to use technology to make it easier to access and manage the standards, guidance and supporting policy information; and

- new risks, new rules – developing APRA’s approach to the regulation of emerging risk areas in a way that is cohesive and integrated with existing standards, rather than bolted on.

The ultimate goal we have been working towards is a digital framework that will be easier for the industry to understand and comply with, and for APRA to supervise and maintain – and ultimately to better protect Australians’ financial interests.

Today, APRA is releasing the new digital framework in the form of the “Prudential Handbook”. The Handbook can be found via a link on our website, and brings together all of APRA’s policy standards, guidance and supporting information into one place. It is presented in a digital format that can be easily navigated and searched, and will cater to a range of different users across regulated industries and in the broader community. For an overview of the new Handbook, please click on the video below.

Next steps

The Handbook will run in parallel with the APRA website (which currently hosts links to standards and guidance) for the next few months to facilitate a smooth transition. We encourage you to use the Handbook (https://handbook.apra.gov.au) and provide feedback at PrudentialHandbook@apra.gov.au. Further background information is presented in Attachment A of this letter.

Yours sincerely

John Lonsdale

Chair

Attachment A. Background on the digital Prudential Handbook

APRA’s prudential framework

APRA sets legal requirements and guidance for the entities it regulates (the prudential framework).

The prudential framework comprises:

- legally binding prudential standards

- legally binding reporting standards

- supporting guidance (such as prudential practice guides).

Each industry that APRA regulates – that is, banking, insurance, and superannuation – has specific prudential standards, prudential guidance and reporting standards that apply to them. In addition, APRA has standards and guidance that apply to multiple industries; these are known as cross-industry standards and guidance.

Modernising the prudential architecture

In 2021, APRA launched a strategic initiative to modernise the prudential architecture (MPA). As we noted at the time, navigating the prudential framework and the network of supporting advice can be complex, as it continues to be updated over time. Complexity makes it difficult for regulated entities to find and understand requirements, complicating risk management and amplifying compliance costs.

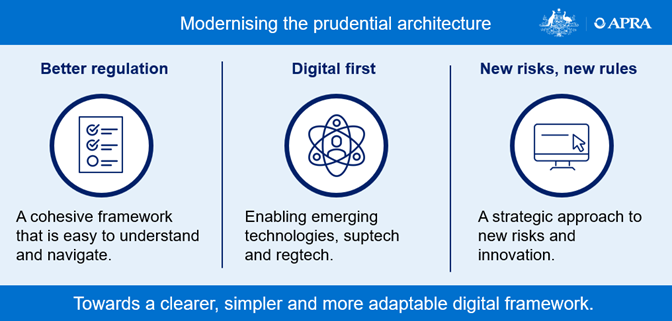

As summarised in the graphic below, there were three parts to the MPA initiative – with the ultimate goal of making the framework clearer, simpler and more adaptable.

MPA has been a multi-year programme that has involved a range of work, and has culminated in the development of a new digital framework – the Prudential Handbook. The Handbook:

- serves as a one-stop-shop: The Handbook brings together all APRA prudential standards and prudential practice guides, as well as associated letters to industry, information papers and FAQs. Reporting standards will currently remain on APRA’s website.

- is simple and clear: The Handbook content is presented in the new prudential framework structure. Standards and guidance are grouped into clear pillars (governance, risk management, financial resilience / business operations, and recovery and resolution planning), and ordered by “core or supporting” – giving a clearer sense of “how things fit together”.

- is easy to use: Built using human-centered design, the Handbook is easy to use with powerful functionalities, allowing you to interact with the framework in a dynamic manner. It provides a scalable platform from which APRA can build out to support better regulation.

APRA is keen for, and welcomes, industry and community feedback on the Handbook. There will be engagement with industry associations through roundtable sessions in early July. APRA expects to release the final version of the Handbook at the end of July, and will continue to enhance the Handbook based on user feedback and needs so it remains fit-for-purpose.

How the Handbook is structured

The Handbook is organised into pillars (or categories). Each pillar focuses on one aspect of an entity’s legal responsibilities, including the risks they must manage. There are four pillars that apply to all entities: Governance, Risk Management, Recovery and Resolution, and Reporting. The fifth pillar depends on the industry: for banking and insurance, it is Financial Resilience; for superannuation, it is Business Operations. Sub-pillars within each pillar further group similar standards and guidance together.

Framework pillars | |

Governance Governance standards require entities to act with honesty and integrity, and to be run by people with the right skills, knowledge and experience. The Governance Pillar includes requirements for good governance, and the fitness and propriety of people in positions of responsibility. It applies to all industries. | Risk Management Risk Management standards require entities to maintain effective risk management strategies and systems. The Risk Management Pillar includes requirements about managing operational risk, and risks specific to an industry including credit risk, insurance risk and investment risk. It applies to all industries. |

Financial Resilience (banking and insurance) Financial Resilience standards require entities to maintain adequate financial resources to withstand stresses. The Financial Resilience Pillar includes requirements such as maintaining capital and liquidity. It applies to the banking, general insurance, life insurance and private health insurance industries. | Business Operations (superannuation) Business Operations standards require RSE licensees to manage their business operations to achieve the outcomes they seek for members. They include requirements for strategic planning, investment governance, operational risk resourcing and insurance. It only applies to the superannuation industry. |

Recovery and Resolution Recovery and Resolution standards require entities to strengthen crisis preparedness. The Recovery and Resolution Pillar includes requirements such as resolution, recovery and exit planning. It applies to all industries. | Reporting Reporting standards apply to all industries. These standards are not currently included in the Prudential Handbook. Access reporting standards from the APRA website. |

Within each pillar are core standards, supporting standards and guidance. Core standards set foundational requirements. Supporting standards are narrower in focus, providing further detail about particular risks or industries. Guidance typically means prudential practice guides (PPGs). Other forms of guidance include letters, FAQs, and information papers. These provide APRA’s view of sound practice in particular areas.

Footnote

1Information paper - Modernising the prudential architecture (apra.gov.au)