The 2024 annual superannuation performance test - trustee directed products

APRA is required to conduct an annual performance test for superannuation products. A total of 590 trustee directed products, or TDPs, were assessed in this year’s test. The assessment under the performance test is intended to hold RSE licensees to account for underperformance through greater transparency and increased consequences.

Trustee directed products, or TDPs, are multi-asset products where the trustee or connected entity has control over the investment strategy and/or the management of investments. There are two types of TDP products:

Related documents

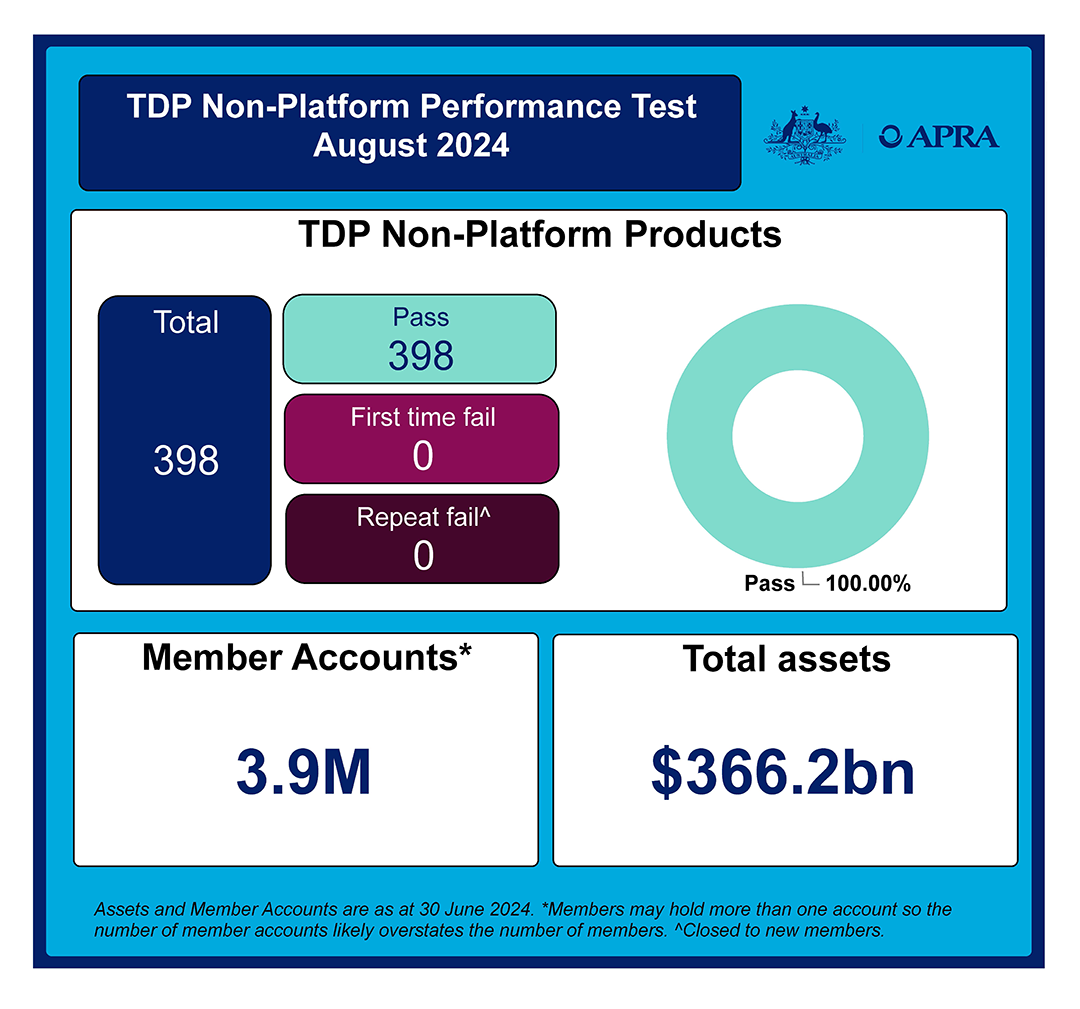

TDP non-platform performance test results

2024 TDP non-platform performance test - accessible version

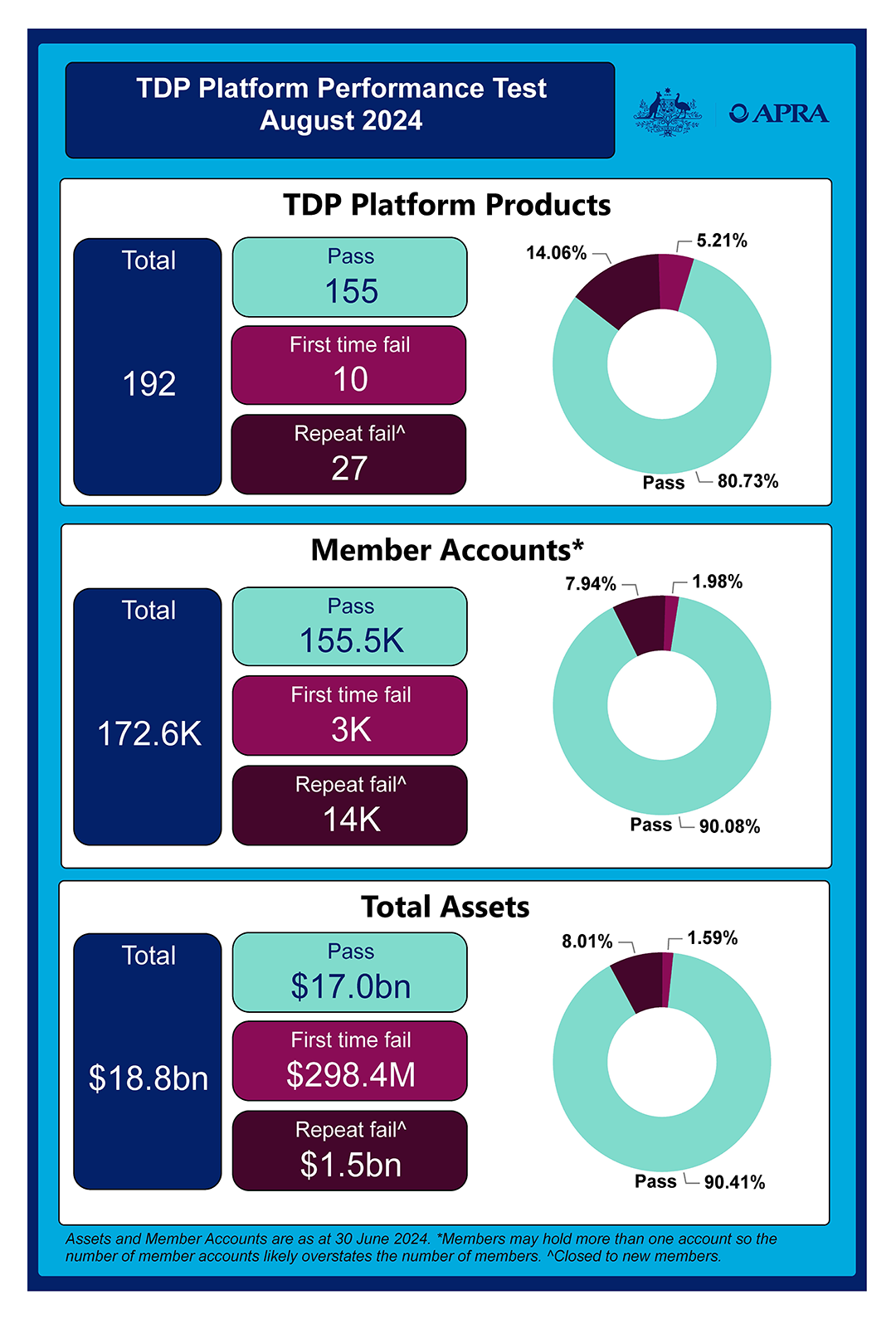

TDP platform performance test results

2024 TDP platform performance test - accessible version

Failing products

Immediate expectations of RSE licensees with failed products

For all products that fail the test for the first time, RSE licensees to:

- Identify the causes of underperformance and develop and implement a plan to rectify this underperformance; or

- If it is in the best interests of members, develop a plan to transfer members to another option, product or fund and/or exit the industry.

- If the product is already closed to new members and the RSE licensee does not intend to exit members, demonstrate why retaining members in the closed product is in members’ best financial interests.

Additionally, for second consecutive fail products, RSE licensees to:

- Ensure the product is closed to new members on the day following the notification.

All RSE licensees of failed products must report regular data to APRA on membership movements in and out of products.

First time fails

| RSE | Investment option name/s |

|---|---|

| Wealth Personal Superannuation and Pension Fund |

|

Second time fails

| RSE | Investment option name/s |

|---|---|

| IOOF Portfolio Service Superannuation Fund |

|

| Wealth Personal Superannuation and Pension Fund |

|

For more information

Email dataanalytics@apra.gov.au or mail to

Manager, External Data Reporting

Australian Prudential Regulation Authority

GPO Box 9836, Sydney NSW 2001Looking for discontinued publications?

Search historical snapshots of APRA's website on the Australian Government web archive.